Client Stories

They Chose FundThrough

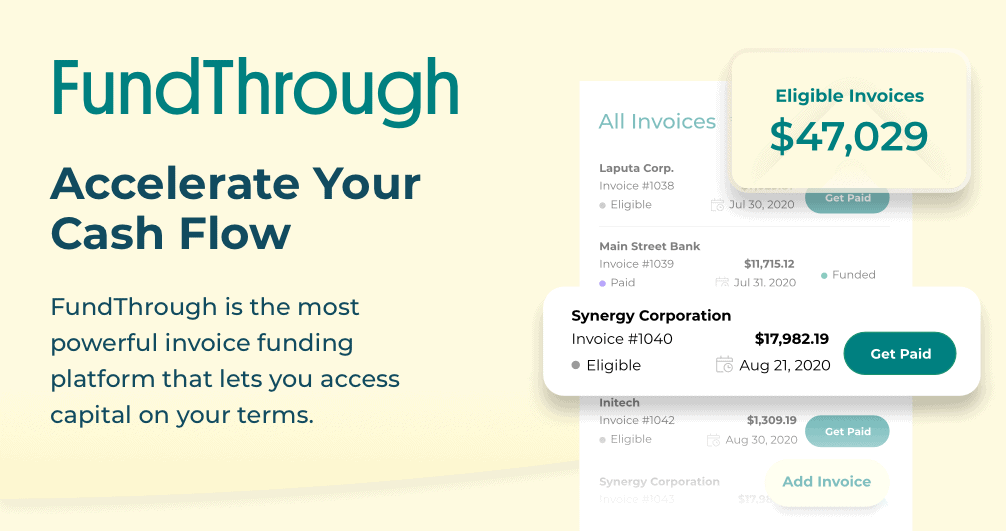

Our clients are our best advocates. Learn how they use invoice funding to grow their businesses.

More and more small businesses are turning to invoice funding as a trusted way to get the working capital they need to thrive.

Small business owners from different industries, different backgrounds, and different customer bases… but one common purpose.

To eliminate the wait of traditional invoice payments and to build their business with money that they’ve already earned.

Given our 95% satisfaction rating and our ability to cut the average wait for payment by 97% – these companies made one simple decision that helped their business grow.

They chose FundThrough.

MapleX Naturals needed working capital to expand its business across Canada. But they didn't want to wait 60 days for customers to pay. Instead, they wanted to boost cash flow quickly. The solution: They chose FundThrough.

READ THEIR STORY

Global Pipeline wanted to bid on a $20 million project and build their business. They needed cash flow now, not in 60 days. To get the money they needed, Global Pipeline chose FundThrough.

READ THEIR STORYBob, “The Sportswear Guy” waited 30-90 days (or more) to get paid, but that schedule put his business in a bind. Today, he no longer has that wait for one reason. Bob chose FundThrough.

READ THEIR STORY

Jesse Harmon needed cash flow quickly to meet payroll and tax obligations after his company grew to 34 employees in just four years. Alaska Thermal Fabrications chose FundThrough, and hasn’t missed payroll or tax payments ever since.

READ THEIR STORYA virtual CFO wanted to give a small business client a leg up and access to $100,000 fast. Her client needed to fund invoices quickly to purchase equipment and pay other expenses. 6DT Conseil and its clients chose FundThrough.

READ THEIR STORY

More from FundThrough

The 10 Best Banks for Small Businesses in 2025

READ

Same-Day Business Funding: 3 Best Options & Tips for Success

READ

Strong Canadian Support is Critical for Small Businesses to Survive—And Even Thrive—Amid Trump’s Tariff Chaos

READ

7 Best No Credit Check Business Funding Options: Success Tips for SMBs

READ

FundThrough Named Best Overall Invoice Factoring Company by Top Business and Finance Outlets

READ

Lima Charlie: Raising $8M in 30 Days to Unlock New Growth Channel

READ