Home Healthcare Invoice Factoring

Accelerate cash flow to make payroll and grow your agency

WHAT'S IN THIS GUIDE

Home health care includes skilled medical and support services in the home, usually under a doctor’s care. But like with most other medical services, it can take months to be paid. Filling out paperwork and dealing with insurance claims, then waiting weeks or months to be paid can lock up cash flow and stop growth.

Invoice factoring for small business and home healthcare agencies can unlock money you’ve already earned and give you access to much-needed funds fast.

Receivables Factoring Can Help Home Healthcare Companies

Shortages in cash flow are common in the healthcare industry. Home healthcare is no different. Payments from Medicare, Medicaid, and third-party insurers trickle in slowly. If your agency provides home care services, factoring your receivables can offer a consistent source of working capital to make payroll and pay your ongoing business expenses.

Factoring for home healthcare companies provides the funds you need when you need it—often within 24 hours. No more waiting months to be paid. It’s an excellent option for any agency that provides temporary or long-term at-home assistance with everyday tasks for people with disabilities, older adults, people recovering from procedures or illnesses, and people with chronic illnesses.

Factoring Is An Option to Traditional Financing

Home healthcare factoring is an option to traditional financing. Especially if you’ve been in business for less than one year. It can take months to qualify and receive funds from loans and lines of credit.

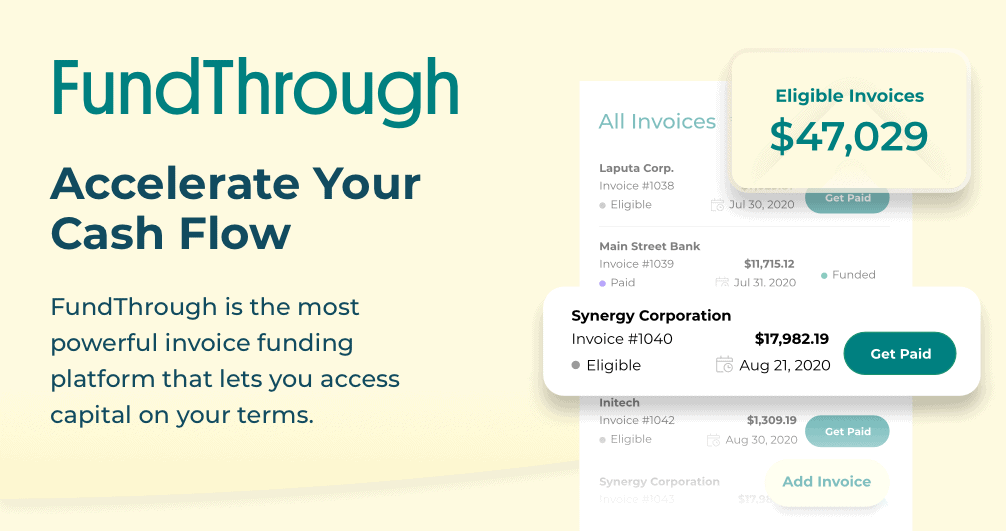

You sell one or more outstanding invoices to a factor, like FundThrough, and get an advance right away with factoring. No monthly payments or high-interest rates, and factoring won’t add debt to your balance sheet.

In addition to increased cash flow, your home healthcare agency can spend less time chasing down payments from government agencies, insurers, and your customers, which frees up time to focus on your business and patient care. Home healthcare factoring ensures your agency has stable funding to not only cover your expenses but manage growth in this expanding medical industry.

How Does Home Healthcare Invoice Factoring Compare With Other Kinds of Business Financing?

In the past, factoring was largely misunderstood. Business bank loans and lines of credit were the traditional and accepted forms of financing, along with credit cards. Each of these different funding options have pros and cons to consider.

Loans

Costs for a new or growing business can be significant. You may need to purchase equipment and inventory, pay employees, and keep up with rent, taxes, and marketing. You may consider taking out a business loan.

Pros

- Many business loans have relatively low interest rates when compared to many other types of funding.

- Interest can be deductible on your taxes.

- Depending on your requirements, you may have access to large sums of money to be used to grow your business.

- On-time repayments can help improve your credit rating.

Cons

- Many small, growing businesses don’t qualify for loans. They often need cash faster than the process would allow anyway.

- Most lenders have strict guidelines for loans and a lengthy review process.

- You may need to have a good credit rating. Anything else and you may not qualify and if you do you’ll likely pay a higher interest rate.

- Rates can fluctuate depending on the market. The more you borrow, the higher interest you may have to pay as the lender takes on more risk.

- A business loan and the debt will show up on your balance sheet, which affect the valuation of your business.

Lines of Credit

A line of credit (LOC) is a lot like a credit card. You can borrow/withdraw money up to a certain maximum amount determined by your financial institution. You can cover day-to-day expenses and pay back your debt, only to borrow again when needed.

Pros

- You can borrow when you need it.

- When you’re short of cash, you can borrow only what you need as long as you don’t exceed your limit.

- Making on-time payments can help improve your credit score.

- Lines of credit can have low interest rates.

- The payments on the line of credit vary and vary depending on your outstanding balance.

Cons

- As with loans, oftentimes banks won’t give small, growing businesses a line of credit. They often need cash faster than the process would allow anyway.

- There will be limits on the maximum amount you can borrow, which might not always be enough.

- Although you pay-as-you-go, if you miss payments, are late, or move outside the terms of your agreement, you might face high fees.

- It’s easy to misuse a line of credit (just like it’s easy to misuse a credit card).

- If your business fails, you are responsible for any payments and debt incurred from using your line of credit.

- You need to have been in business at least two years, and will need to provide bank account information, financial statements, tax returns, and more to qualify.

- A line of credit is like a loan that needs to be repaid with interest.

Business Credit Cards

Like all forms of funding, business credit cards must be used wisely or things can go sideways very quickly.

Pros

- It’s easier to qualify for a business credit card than for a line of credit or business loan.

- You have quick access to the cash you need when you need it.

- Many business credit cards have reward programs or incentives, like cash back or airline miles.

- A business credit card can help build credit, which is helpful if you ever need to apply for a bank loan.

Cons

- You may need to provide a personal guarantee to qualify.

- High interest, annual fees and late charges can add up, especially if funding a large expense.

- Many business credit cards do not offer purchase protection.

- Business credit cards come with security risks like fraudulent charges from unauthorized use and stolen credit card numbers.

- You risk overspending.

Receivables Factoring

Invoice factoring is not a loan. The application process is quick, there is no repayment obligation, no high interest rates, and no debt to record on your company’s balance sheet. Plus, many more companies will qualify.

Pros

- You have access to fast cash when you need it based on the value of your invoice(s).

- Cash advances can greatly improve shortfalls in cash flow due to slow-paying clients.

- Does not require your business to have a long credit history, which is best for start-ups and fast-growing firms.

- Factoring relies on the creditworthiness of your customers, not yours.

- Invoice factoring is easier to obtain than most other forms of funding.

- Funding can increase with the value of your invoices.

- If your business is seasonal, factoring can infuse cash into your business to get you through the downtimes.

- Your accounts receivables are used as collateral, unlike many loans or lines of credit.

- You give up no equity or control in your business in exchange for funding with factoring.

- No matter the size of your business, you can use factoring.

Cons

- Invoices need to be verified (customer contact sometimes required)

- Can be complicated to account for in bookkeeping

How Do You Choose a Home Healthcare Factoring Partner?

Choosing a factoring partner is a lot like choosing any lender. It pays to do your homework. There are also several questions to ask prior to starting the application process:

Does the factoring company work with home healthcare?

Most factoring companies work with most industries, but not all. Some factors specialize in only a few industries.

FundThrough works with home healthcare companies.

What advance rates does the factoring company offer?

Advance rates can range from 60% to 100%, depending on the factoring company and sometimes the industry.

FundThrough advances 100% off the invoice amount, less a fee.

What factoring fees does the factoring company charge?

A factoring company should be able to provide what factoring fees it charges upfront. But some companies may make it difficult to determine the total costs of using their service. FundThrough offers transparent pricing so you know prior to signing an agreement.

FundThrough pricing – 100% advance rates minus a flat fee. One upfront price.

Does the factoring company have minimums?

A minimum is the amount you must factor every period (month, each quarter or every year). Some factoring companies offer plans that require minimums, while others do not.

FundThrough doesn’t require minimums. Only fund when you need to.

Is Home Healthcare Factoring Right For Your Business?

Cash flow is the number one problem for most start-ups and small businesses, especially if they’re growing. This is also true for home healthcare. Invoice factoring companies typically consider several situations before offering you an advance.

- Nature of the business: you must be a registered business selling goods or services to other businesses.

- Service completion: invoice factoring is only available for goods or services that your clients have marked as complete or delivered.

- Encumbrance-free invoice: since invoices are the only collateral in a factoring arrangement, encumbrances such as tax liens can make it difficult to qualify for factoring. (But not impossible. FundThrough works with businesses on IRS and CRA tax payment plans all the time. We can even help you with getting an arrangement set up).

Factoring invoices is a sound financial strategy if you—

- Spend time tracking down slow-paying customers and waiting 30, 60 or 90 days to be paid, which puts a tremendous burden on your business.

- If you’ve delivered a product or provided a service to another business.

- If you have slow times, downtimes, or your business is cyclical.

- You experience times of cash flow crunch.

- You need access to working capital to grow as a home healthcare business.

- You can’t qualify for a loan.

- Your customers or clients are creditworthy.

FundThrough takes the legwork out of accounts receivables financing. It’s fully automated platform is easy to navigate, it’s fee structure is transparent and a customer service rep is there when you have questions. Find out what FundThrough’s clients have to say, and start factoring your invoices today.

Simple. Intuitive. Home Healthcare Invoice Factoring.

Built For Your Business.

Invoice Factoring Resources

Strong Canadian Support is Critical for Small Businesses to Survive—And Even Thrive—Amid Trump’s Tariff Chaos

READ

7 Best No Credit Check Business Funding Options: Success Tips for SMBs

READ

FundThrough Named Best Overall Invoice Factoring Company by Top Business and Finance Outlets

READ

Lima Charlie: Raising $8M in 30 Days to Unlock New Growth Channel

READ

Liquid Gold Trucking: Fueling 30% Growth in 18 Months With Early Invoice Payments

READ

FundThrough Ranked Number 415 Fastest-Growing Company in North America on the 2024 Deloitte Technology Fast 500™

READ