The 10 Best Banks for Small Businesses in 2025

Key Takeaways: Key Features to Look for in a Small Business Bank: Small business owners should prioritize customer service, security, competitive rates, and comprehensive features

Ace Recruitment’s Account Manager, Sami Boubertakh, spoke with FundThrough about the challenges he and his business partners face in growing their Ontario-based staffing agency.

Running a staffing agency is a tough job. Every day brings new challenges, and one of the toughest issues to face is having access to positive cash flow. Without it, you can’t grow your team or invest in marketing, and sometimes even paying your existing staff on time can be difficult.

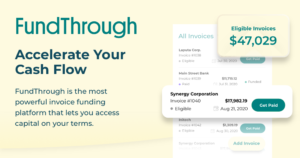

At FundThrough, we understand the pain around clients taking 30, 60, or even 90+ days to pay invoices, and wanted to share some insights on the issue from one of our own clients, Ace Recruitment LTD.

Roughly four years ago, I opened my own staffing agency. Then about three years in, I ran into capital issues and couldn’t maintain the business anymore.

At that point, I decided to take all of my clients to Ace Recruitment with someone I know who has been in the industry for 15 years. I handle the account management, and the owner and his wife manage the other aspects of the business.

Ace Recruitment has been going for slightly over a year, and during that time we’ve grown quite a bit. In terms of number of temps and temp to permanent hires we’ve placed, we’re in the triple digits. My current focus is the food and manufacturing agencies, specifically textile companies.

In the first week we start sending out personnel to their location. Usually the week after is when the workers expect to be paid, so we then invoice the client. We like to get clients that can pay a week after or on net-10 terms. Right now, that’s not realistic, so we get the time sheet, invoice the client, the client approves, and we go through FundThrough PRO Invoice Factoring to get funding.

It’s at least two weeks from that point when we receive payment from the client. Overall, we’re looking at around four weeks or more from when we start and when we get paid, even though we cover all of the costs up to that point.

I’d say for anyone in the staffing world, the goal is to have one large company, and then smaller companies that you grow with over time. The idea would be that the larger company helps hold up the smaller ones until they become regular paying clients. Usually the smaller ones have payment terms that are longer than bigger companies, which is difficult.

The impact on cash flow is why we need money to pay the associates, the workers, and our employees. That’s before we even think of paying ourselves, so when you have so many families that rely on you every week to pay them and you have a client that can’t pay weekly, it can cause big issues.

Negatively the way it impacts us is not having cash flow means word gets around that your agency can’t afford to pay its workers. There’s not a shortage of agencies, so to avoid that we needed to find a funding company to help us with cash flow so we can focus on growing the company.

I heard about invoice financing when I was in my own business prior to Ace Recruitment. I really couldn’t do something like that at the time because the invoices weren’t very large, and I didn’t want to lose that much in fees.

When I came to Ace Recruitment, we landed a client who was supposed to pay every 45 days, but we would be incurring billings of tens of thousands a week. The question was, how are we going to maintain that for six weeks when we didn’t have that type of capital?

We were a new business, so I looked online and found a company – this is before I found FundThrough. I found a company, and I liked what they did and the way they worked, but I came to find it was too old-fashioned. There was a lot of back and forth, and they needed to be in touch with my clients, so a lot of jumping through hoops.

We decided it was just too complicated, so I went through to look for a newer company that wasn’t so old-fashioned. I don’t remember what I searched for on Google, but that’s how I found you.

Before we solved our cash flow issue, my strategy was simply to not accept any clients that couldn’t pay on net-14 terms.

That’s changed with having access to funding, so my strategy now is to target larger clients that can accept net-30 terms. I can bring them in, fund those invoices, and not take a massive hit until I get my remittances.

Key Takeaways: Key Features to Look for in a Small Business Bank: Small business owners should prioritize customer service, security, competitive rates, and comprehensive features

Key Takeaways: Same-day business funding offers quick access to capital for emergencies, growth opportunities, and operational expenses, with options like invoice factoring, short-term loans, and

Canada’s small businesses are under siege. Ever since U.S. President Donald Trump announced a 25 percent tariff on Canadian imports, the fallout has been swift:

Key Takeaways Many alternative lenders offer business funding without conducting a credit check, focusing instead on business revenues and cash flow, providing a viable option

TORONTO – March 18, 2025 – FundThrough, a leading AI-powered invoice funding platform, has been recognized as the Best Overall Factoring Company by Forbes Advisor,

https://youtu.be/DwrNdfg3pHs When Ron Cedillo, VP of housing provider Lima Charlie, had to find new sources of business, he learned that the government contracting space

Speak with your dedicated account manager on the phone or online.

Interested in possibly embedding FundThrough in your platform? Let’s connect!