How This Tech Company Keeps Up With Their Multi-Billion Dollar Clients.

Self Care Catalysts (SCC), a Canadian health-tech firm, has developed a leading platform to gain a holistic view of the patient’s health journey to enable

By FundThrough

Home » FundThrough Blog » How This Tech Company Keeps Up With Their Multi-Billion Dollar Clients.

Self Care Catalysts (SCC), a Canadian health-tech firm, has developed a leading platform to gain a holistic view of the patient’s health journey to enable better healthcare decisions, care, and outcomes. The platform supports multiple use cases. These include patient monitoring, patient journey data gathering, digital therapeutics, and real-world evidence generation. The latter is of particular relevance in the current pandemic. SCC has recently been engaged to help understand the real-world response to COVID vaccines as safety surveillance programs get underway around the globe.

SCC’s growth and success has, however, been enhanced by its ability to optimise its cash flow management.

In a conversation with Self Care Catalysts Chief of Staff, Nigel Page, we discuss how the company has successfully navigated cash flow challenges and why it could become a household name given its revolutionary advancements in the healthcare ecosystem.

Self Care Catalysts began to evolve from a patient-research business into a technology company in 2014 under the direction of Founder Grace Castillo-Soyao. Over the last six years, its tech platform has gathered real-world information from patients worldwide.

As Chief of Staff Nigel Page explains, the company seeks to put patients at “the intersection of human networks, technology, and science.”

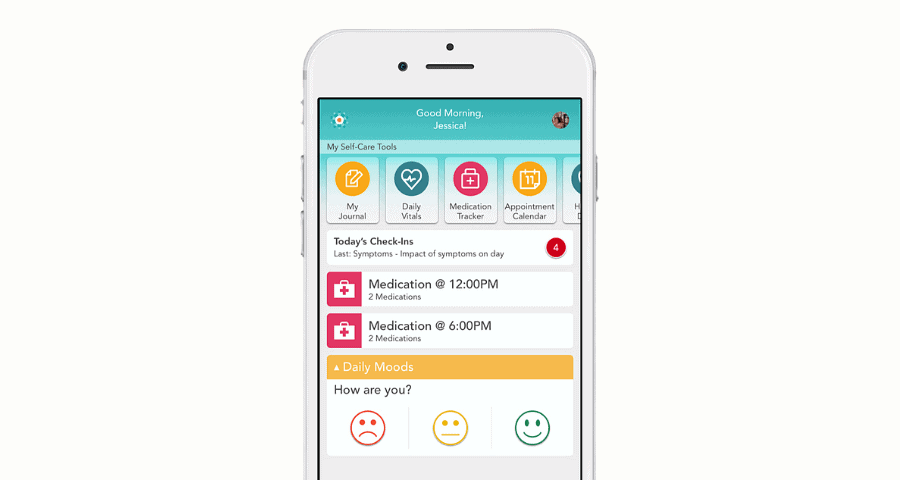

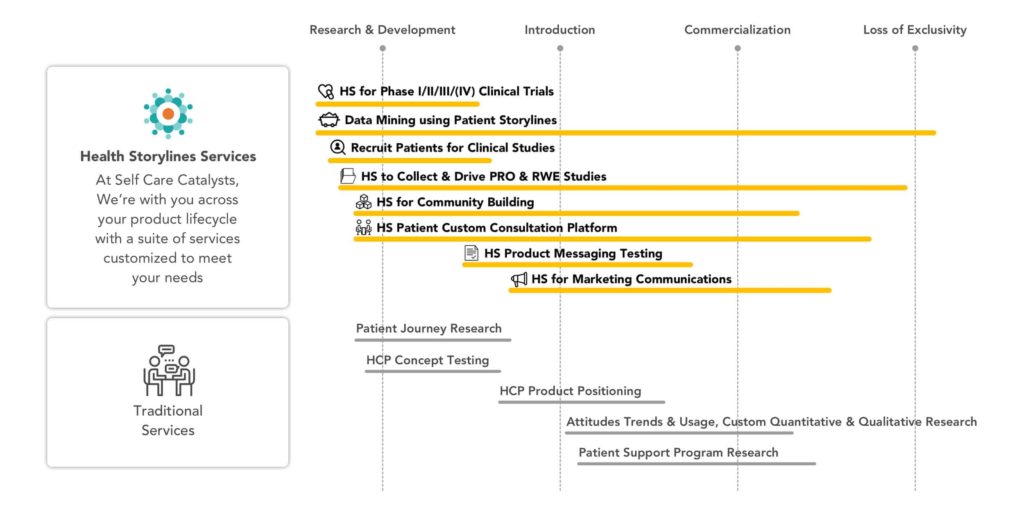

Today, it gathers and analyzes real-world patient data across a very broad range of therapeutic areas and disease states to improve clinical care, maximize product life cycle management, and measure and effect change in patient behavior. SCC goes beyond traditional patient data-gathering to provide its clients with a much richer data set.

Grace Castillo-Soyao had several decades working at Procter & Gamble, Novartis, and Pfizer. Before SCC, Grace saw critical, multi-billion decisions being made for patients which impacted clinical care, patient outcomes, drug development, and commercialization, but with only a limited understanding of their experiences and preferences… This experience helped Grace identify the gap in patient information gathering.

“Typically, stakeholders only capture about 10% of healthcare data during the interactions between patients and the health system,” Nigel says.

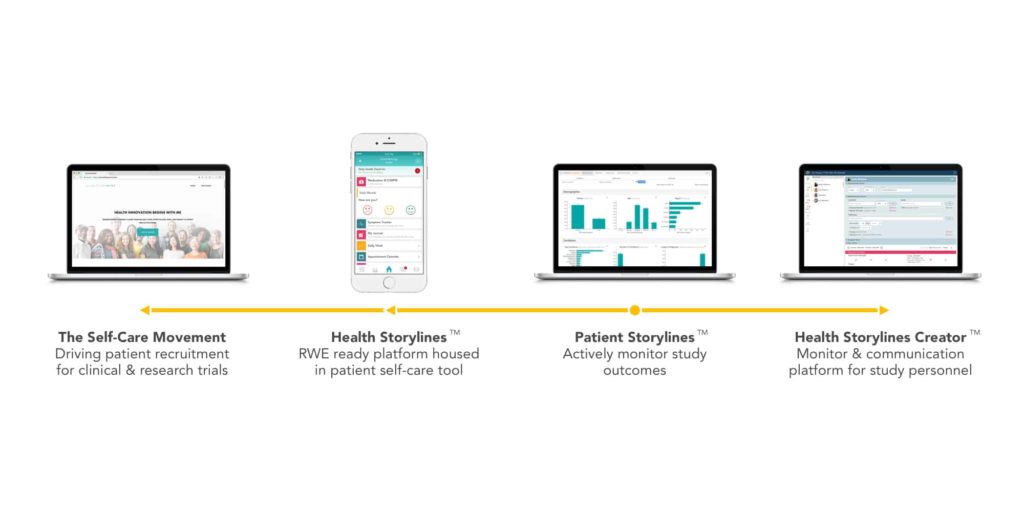

Nigel says that SCC’s goal is to capture and analyze the other “90%” of data through three specific platforms:

SCC has a broad customer base. This base includes pharmaceutical manufacturers, hospital systems, academic institutions, and clinical research organizations. Each customer has a unique mission in using patient data to improve processes and make more informed decisions.

“We are providing insights from those patient data. For example, this could be in support of a regulatory submission, it could be in support of a regulatory requirement to help companies monitor the safety of a drug after authorization by the FDA,” says Nigel.

Self Care Catalysts has a strong roster of customers. While some generating billions of dollars each year in revenues, these same customers commonly have payment terms which can, at times, create a challenge for a much smaller player.

“The customers are well-known names, often very large companies, but whose payment terms may run to 90 days or more.

It is not just the length of the period, however, which poses a challenge. Some contracts may have a milestone payment structure too, resulting in uneven cash flow for SCC even if it is 100% guaranteed.

“Before we engaged FundThrough, there were times in the past that meeting our financial obligations was challenging simply as a function of timing,” Nigel says.

Self Care Catalysts looked at a variety of solutions in order to address its cash flow needs and concluded that factoring could be appropriate for them. It focused on using invoice factoring with FundThrough as a reliable method to ensure it always had cash available when it needed it.

With FundThrough’s factoring platform, Self Care could take yet to be paid customer invoices and use them as collateral to obtain quick, easy working capital.

FundThrough would provide a lump sum payment in exchange for the invoices, eliminating the waiting period for customers to pay, and then take payment from the customer at a later date, based on the current payment terms.

Nigel cited three reasons why his company preferred this method of funding.

SCC used FundThrough to boost cash flow and pay various fixed costs. But working capital goes a long way in healthcare and technology.

Given that SCC is a tech company, it also must evolve constantly. For example, the company used this boost in working capital to recruit specific expertise needed to continue to develop its technology platforms.

“We’ve needed to add new functionality to address changing market dynamics and opportunities, “The next iteration of our platform Health Story Lives is already being built.”

Finally, the company plans to use available capital to ramp up its marketing. Although it has a strong customer base, it has largely relied on word of mouth referrals.

Nigel says that during the process of evaluating various factoring companies, FundThrough stood out for several reasons.

“What was remarkably refreshing was FundThrough’s interest in what we did beyond the numbers,” he says. “That was very meaningful for us. SCC is an organization that was built on a very human foundation. When we find people who desire to understand more than balance sheets and cash flow statements, that is meaningful to us.”

Nigel notes that FundThrough is down the road from SCC. While the location itself was not the determining factor, it has been beneficial to have local contacts

Finally, Nigel notes the quality of FundThrough’s customer support.

“The response of customer service was outstanding. This definitely set FundThrough apart from other factoring companies we explored,” he says.

Nigel also notes that FundThrough’s flexibility has made it an essential strategic partner in its growth this year.

“As our situation and business has evolved, it’s like FundThrough has come with us,” he says. “The willingness to consider that we are always evolving, and we’ve come on this journey together. FundThrough is also very flexible. On more than one occasion, we’ve investigated new methods to work together. The willingness of FundThrough to talk through that context has been amazing. We feel an enduring sense that choosing FundThrough was a good decision and the right decision. We’re very pleased we made it.”

While 2020 has been about growth and development, the year 2021 will likely put Self Care Catalysts firmly on the global map.

“We’ve always punched above our weight, but we’re about to embark upon a journey where the world’s eyes will be on us,” Nigel says, as SCC will be involved in COVID vaccine surveillance for some of the recently launched products coming onto the market.

“It’s a testament to the platform and Grace and the team,” Nigel says. “The company just received its largest award in its history, and this in turn will open up new projects, new geographies and additional opportunities for the future.”

“It also, however, represents a point where we have to scale in a short amount of time to serve that need, ahead of being able to reap the successes which will follow,” Nigel says. “This is another reason why working with FundThrough so support cash flow has been beneficial.”

While there are many quantifiable benefits to the use of FundThrough’s factoring platform – like having the working capital for hiring and platform development – Nigel cites the most important one of all.

“Due to FundThrough we haven’t just survived the challenges of 2020, we have thrived and been able to capitalize on the new opportunities which arose. If we hadn’t found FundThrough this success may well have eluded us.”

When asked what business owners who need funding should do to solve their cash flow gaps, Nigel said that he could answer this question in six words.

“Stop looking elsewhere and sign up,” he says.

FundThrough will continue to work with Self Care Catalysts in 2021 and continue growing and taking on new business. Don’t be surprised if you see this company’s name in the headlines as it helps the global healthcare industry address new challenges in the year ahead.

But Nigel has one last recommendation for small business owners.

“If someone is in the position where there is uncertainty about the arrival of payment, if they do not want to seek other forms of institutional investment, or if they’re looking for a solution that can move and flex as they do, then factoring is fantastic.”

To learn more about how factoring works and how we might help your business get the cash flow it needs to thrive, visit FundThrough.com.

Self Care Catalysts (SCC), a Canadian health-tech firm, has developed a leading platform to gain a holistic view of the patient’s health journey to enable

Franchiser of Must Boutique Stores Gives FundThrough Two Perfect Reviews for Invoice Funding Solutions. Many small business owners have similar memories after the economy’s first

TORONTO – FundThrough, North America’s leading invoice funding solution for small businesses, has announced it will provide $10 million in free funding for clients as

With parts of the North American economy reopening, you might be eager to rebuild your business and get back to work. It’s important, however, to

FundThrough is an alternative finance company that specializes in invoice funding for small businesses across the United States and Canada. We have a large number

Interested in possibly embedding FundThrough in your platform? Let’s connect!