The 10 Best Banks for Small Businesses in 2025

Key Takeaways: Key Features to Look for in a Small Business Bank: Small business owners should prioritize customer service, security, competitive rates, and comprehensive features

By FundThrough

Toronto, ON – FundThrough, a financial technology company that helps small businesses unlock working capital tied up in accounts receivable, celebrates the recent success of its client Run Veggie which played a pivotal role at the 2021 Presidential Inauguration.

On January 20, 2021, Run Veggie prepared 10,600 meals for the Washington D.C. police force that provided security for U.S. President Joe Biden’s Inauguration. Under a tight deadline and on short notice, the company and its partners procured breakfast and lunch for the officers for the event, which was under heavy security but watched by 40 million viewers on television.

Run Veggie was founded by entrepreneur Jermaine Kelly in October 2018. Kelly started the company after noticing challenges that many restaurants, food production, and beverage customers faced in procuring raw ingredients. Kelly began procuring products, building an inventory of much-needed products, and connecting buyers and producers. Today, it operates in five cities and caters to private businesses and government agencies.

The company will expand into four new markets in the coming months. Kelly says that his firm will soon start operations in Miami, Chicago, San Jose, and Atlanta.

“We congratulate Run Veggie on its important role in the Inauguration and its expansion plans in the year ahead. Jermaine Kelly is a terrific entrepreneur, and it has been a pleasure to see Run Veggie grow at such an incredible pace,” said FundThrough CEO and Co-Founder Steven Uster. “We look forward to providing continued funding support to the company as it expands into its new markets in 2021.”

Run Veggie partners with FundThrough to accelerate its cash flow and take on new customers and larger projects. In Washington D.C., government contracts typically undergo a bidding process by vendors. Under the stringent application process, decision-makers examine a company’s ability to procure materials, deliver products on time, and have the necessary cash flow to meet these obligations.

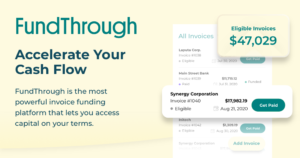

Given that contractors typically have payment terms of 30 days or more, cash truly is king. In order to have enough cash flow on hand, Kelly uses FundThrough’s invoice funding platform. Kelly exchanges unpaid outstanding customer invoices to FundThrough and receives the full value of his invoice within 24 hours or less. The working capital allows Run Veggie to purchase raw materials quickly and bid on bigger contracts.

“Having a partner like FundThrough enabled us to have the capabilities of funding the financial aspect of our Inauguration project. We had to buy a lot of food and bring in a lot of additional labor in just six days,” said Jermaine Kelly, Founder of Run Veggie. “With all of the food and labor required – having FundThrough as a resource was pivotal to our success.”

Kelly says that the company’s cash flow position, with the help of FundThrough, has allowed it to take on much larger projects. In 2019, its average contract was relatively small as Kelly spent time building the business and relationships with customers. In 2020, the company, with stronger cash flow, bid on seven-figure contracts. In 2021, it is already primed to bid on contracts potentially worth upwards of eight figures.

FundThrough is a leading fintech company that enables businesses to access unlimited capital based on the value of their outstanding customer invoices. Its platform lets businesses connect their accounting software and directly submit invoices for funding. On average, FundThrough improves its clients’ cash flow position by reducing their wait time by 97%. The company serves clients across the United States and Canada. For more information, please visit www.fundthrough.com.

Run Veggie is an innovative food distributor that services multiple cities across the USA. Founded in 2018, the company has built a reputation for delivering high-quality products in tight deadlines and providing exceptional customer service. For more information please call (202) 539-2480 or email the team at [email protected].

Key Takeaways: Key Features to Look for in a Small Business Bank: Small business owners should prioritize customer service, security, competitive rates, and comprehensive features

Key Takeaways: Same-day business funding offers quick access to capital for emergencies, growth opportunities, and operational expenses, with options like invoice factoring, short-term loans, and

Canada’s small businesses are under siege. Ever since U.S. President Donald Trump announced a 25 percent tariff on Canadian imports, the fallout has been swift:

Key Takeaways Many alternative lenders offer business funding without conducting a credit check, focusing instead on business revenues and cash flow, providing a viable option

TORONTO – March 18, 2025 – FundThrough, a leading AI-powered invoice funding platform, has been recognized as the Best Overall Factoring Company by Forbes Advisor,

https://youtu.be/DwrNdfg3pHs When Ron Cedillo, VP of housing provider Lima Charlie, had to find new sources of business, he learned that the government contracting space

Interested in possibly embedding FundThrough in your platform? Let’s connect!