The 10 Best Banks for Small Businesses in 2025

Key Takeaways: Key Features to Look for in a Small Business Bank: Small business owners should prioritize customer service, security, competitive rates, and comprehensive features

So, you’ve decided or are considering becoming a vendor for retail, e-commerce, and/or B2B businesses — congratulations! As entrepreneurs ourselves, we understand the excitement of chasing a new venture. As with any new venture, there’s a lot of prep work that needs to be done, and the challenges can be tough. This piece will explain how to get started as a retail vendor and how to set yourself up for success.

You might be wondering, what is a vendor in business? In layman’s terms, a vendor is an individual or a company that offers a service or makes goods available to other businesses, individuals, or government organizations for purchase. A Coca-Cola bottler is a vendor to the local grocery store. A manufacturer who produces goods to sell to wholesalers are vendors to retailers. In the same way, a vegetable street vendor selling in downtown business districts is a vendor to consumers. There are many types of vendor across a broad range of industries.

One common type of vendor is a retail vendor. A retail vendors (or retail suppliers) is simply just a business or individual that offers goods and services to retailers. A fabric supplier would be a retail vendor for a clothing store, while a garden supplier would be a retail vendor for a flower shop.

As business owners, retail vendors need guts and grit to compete and succeed. There is no one type of person for the job, as most common skills can be learned. You don’t even need a fancy school diploma! However, most retail vendors are self-driven people who have learned the most important aspects of running a business and keep up with what’s going on in their industry. If you’re wondering how to become a vendor, think about whether you have – or can learn – these important skills.

When it comes to taking steps to bring your goals to fruition, you might be wondering how to become a vendor. While there’s no real clear-cut path for how to become a vendor–and certainly no application process or college degree required–there are some steps you should follow to ensure you’re on the right path. Taking these steps will ensure you’re gaining the necessary knowledge and experience in order to make yourself stand out and be successful as a retail vendor.

As someone who wants to become a retail vendor, one of the most important things you can do is get to know the industry you represent. It’s fundamental that you can explain the industry’s purpose, potential for growth, the major roles of people in the industry, the general state of the industry, and how your business model fits into the landscape. This is big part of honing your business operation.

Many of the people who successfully become retail vendors already have relevant business experience, often working as employees or managers in the industry. If you don’t have that experience, ask people in the industry if they can spend a few minutes answering your questions – also a great networking opportunity. There’s a wealth of information you need to know, but here are a few points to start with:

The more you know about your industry, the more advantages you will have.

Business goals are the actionable steps you need to take to grow as a retail vendor. Without clearly defined business strategy, you have no way to measure your success or steps to get there. Of course, you can set high-flung goals that you have no way of meeting, or you can set reasonable goals with action steps to help foster a successful outcome. We like to use the SMART goal-setting system.

By laying a stable foundation on which your business can grow, you can be a successful vendor for years to come. Consider various aspects such as production capacity, product availability, quality control, and distribution logistics before letting a retailer know you’re ready for their order. If you cannot get the product on the shelves, or a faulty product is returned, you could irreparably damage a once-in-a-lifetime relationship, and your competition is waiting right outside the door.

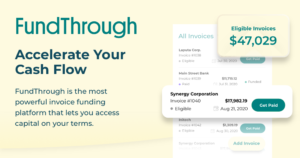

One of the most common challenges that can cripple and sink a growing company is financial difficulties. Without enough money to produce your product or even keep the lights on, you’re in trouble. Building up a sufficient cash reserve is difficult in the beginning, and funding for small businesses can be hard to come by since banks often aren’t interested in working with new companies. Invoice factoring for small business, invoice factoring for apparel, or invoice factoring for wholesale can help cover any cash flow gaps and ensure you have the necessary funding to cover payroll, purchase supplies, and go after big opportunities that can help your business grow.

As you’re setting up your business, be aware that you might have to register if you want to work with governments. You might also need to get a business sales license to sell goods in certain states or provinces, or cities. Often, there’s an application and a fee you’ll have to pay to secure a vendor license.

The authority issuing your vendor license may require an inspection of your premises or vehicle, if applicable. In addition, there may be specific tax registrations you’ll need to make as a vendor, depending on the state or city you’re doing business in to ensure that your business is collecting and remitting tax appropriately.

In many cases, a vendor license may only be good for a year, so you’ll need to stay on top of any renewal forms or fees to stay current with your business status and registrations.

When you become a retail vendor, your relationships can either elevate your product to mass adoption, or add you to the long list of failed products. If you want to be the next iPod and avoid the fate of the Zune, networking and marketing your business will be critical.

Find out who makes purchasing decisions in your industry and then learn all you can about them! This includes people such as purchasing managers in retail, or buying committees in other complex B2B businesses. Once you know who they are, you can create and execute marketing campaigns to them. Account-based marketing via LinkedIn can be a good place to start if you have a list of target accounts. If you’re a local business, attending local business-related events to network can help you form valuable connections and start getting your name out there.

Now comes the exciting part — negotiating your first sale! Things to keep in mind include ensuring you negotiate a good price, feasible delivery date, and payment terms. Make sure you put everything into a clear, detailed contract. Our blog on customer contracts has everything you need to know to create a successful customer contract.

For many B2B industries, long payment terms are common and expected – but they can stifle cash flow that’s critical for helping you fulfill future orders, make payroll and grow. Getting invoices paid in days ahead of net terms can solve this issue quickly and easily.

Vendor portals offer a centralized vendor management system that helps suppliers learn vital product information, pricing strategies, periodic updates, see product images, and much more. Each portal is a bit different, so it pays to take the time to learn a portal well and set up your vendor profile with detailed product descriptions.

Another element for those who want to know how to become a vendor to capitalize on is open vendor days. Many retailers hold these events to connect with new and prospective vendors, share information, show product samples, and develop personal relationships. Take the time to prepare small presentations and product demos to show the retailer why they need to take you seriously and how well prepared you are for their business.

If we can offer one last word of advice – keep a positive attitude. There will likely be setbacks and disappointments as you work toward becoming a vendor. It’s part of the process, and part of entrepreneurship. We speak from experience when we say to keep chasing your dream. If you believe in your product, can learn from your mistakes, and aren’t afraid to try new things, you’re more likely to enjoy the journey and business opportunities that come along.

FundThrough helps small business owners (including those looking at how to become a vendor) navigate cash flow hurdles. All it takes is just a few minutes to get started. If you’ve been waiting up to 90-days or more to be paid on your invoices, our customer service team is standing by ready to fill your cash flow gaps with small business invoice factoring.

Key Takeaways: Key Features to Look for in a Small Business Bank: Small business owners should prioritize customer service, security, competitive rates, and comprehensive features

Key Takeaways: Same-day business funding offers quick access to capital for emergencies, growth opportunities, and operational expenses, with options like invoice factoring, short-term loans, and

Canada’s small businesses are under siege. Ever since U.S. President Donald Trump announced a 25 percent tariff on Canadian imports, the fallout has been swift:

Key Takeaways Many alternative lenders offer business funding without conducting a credit check, focusing instead on business revenues and cash flow, providing a viable option

TORONTO – March 18, 2025 – FundThrough, a leading AI-powered invoice funding platform, has been recognized as the Best Overall Factoring Company by Forbes Advisor,

https://youtu.be/DwrNdfg3pHs When Ron Cedillo, VP of housing provider Lima Charlie, had to find new sources of business, he learned that the government contracting space

Interested in possibly embedding FundThrough in your platform? Let’s connect!