As small business owners and entrepreneurs ourselves, we know how important it is to thoroughly explore a business funding method before you try it. If you’re researching invoice factoring, this post will cover three invoice factoring examples (and more!) that show you how it can work in different scenarios. When you’re done reading, you should have more information to help you decide if factoring is right for you.

How Do You Factor an Invoice?

The first step in learning about how invoice factoring works is to learn what invoice factoring is. Invoice factoring is a type of receivable financing where a business sells its outstanding invoices to a factoring company (a.k.a. a factor, for short) for payment ahead of the original invoice terms, which are often 30, 60, or 90 days long. The factoring company gives you a cash advance (minus any factoring costs) and then collects the invoice from your client according to the original payment terms, while you enjoy immediate payment for work you’ve already completed. Looking at it step-by-step, here’s how the invoice factoring process works:

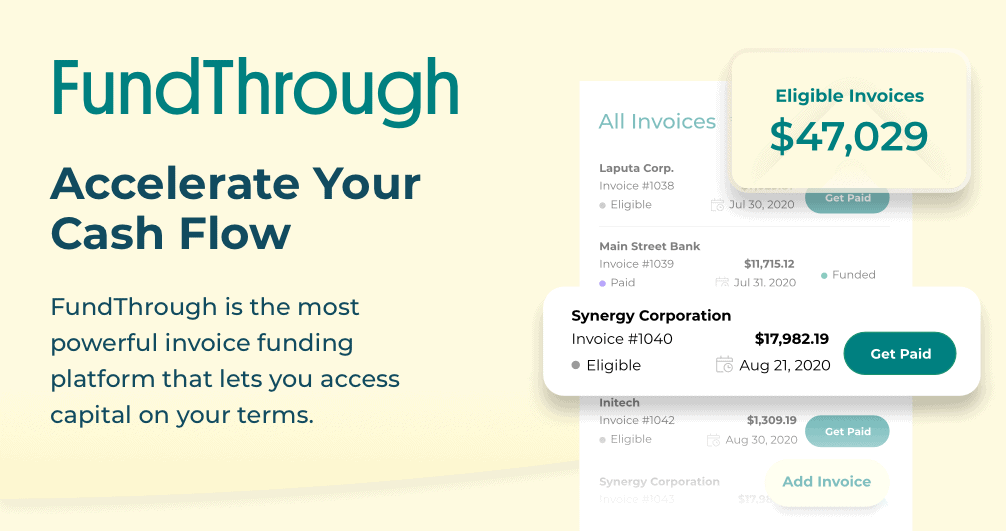

1. Create (or connect) your account. The first step in factoring an invoice is to create a free account or otherwise sign up with your factoring company of choice. (With FundThrough, you have the option to connect your QuickBooks or OpenInvoice account to our dashboard to automatically pull in eligible invoices.) After that, provide some basic information about your business.

2. Select which invoice(s) to fund. If your factoring company has an online portal, you can upload unpaid invoices directly. Otherwise, you’ll need to send invoices to your factor according to their procedure. Traditional invoice factoring companies often require a business to factor all their invoices for the duration of a contract. With many newer companies, you have the flexibility to pick and choose which invoices you want to fund.

3. Factoring company does due diligence. Oftentimes this will include checking that a business is legally established, is up-to-date on taxes, and doesn’t have liens on their accounts receivable and/or the specific invoice. (Many factoring companies will find ways to work with businesses if they have these issues.) During this step, the factoring company will also verify that the invoice is real. Once the approval process is complete, you’re now a candidate for invoice factoring!

4. Your customer is asked to sign an NOA. Having the customer owing the invoice sign a Notice of Assignment means they understand that the factoring company now owns the invoice so they can redirect payment. While a lot of business owners get concerned about their customer being involved, many large companies are used to this process.

5. You get funded. Upon approval, funds are deposited into your business bank account as soon as the next business day with many factors. It can take others a few days. You have peace of mind that you have access to cash available to grow your business or cover any other cash flow gap. You now have cash on hand to go after growth projects, cover payroll, purchase equipment, make strategic hires, and more.

6. Your customer pays the factoring company. When the invoice is due, your customer simply pays the factoring company, and the process is complete.

Keep in mind that every receivable factoring company, business, and their customers are different, so these steps to the process of invoice factoring have been generalized accordingly.

What Is the Purpose of Invoice Factoring?

There are several purposes of invoice factoring. Overall, the purpose is to get working capital for your business, without taking on debt like a bank loan or giving away equity in your business.

There are some common reasons business owners need working capital, and turn to invoice financing to access flexible funding, including:

Payroll. One of the most common reasons to factor an invoice is to cover payroll. Just because you have slow-paying customers, doesn’t mean your business expenses stop! Invoice factoring providers give you peace of mind that you can meet any financial obligations to your business.

Growth projects. Many business owners fund invoices so that they can pay upfront costs associated with landing a big contract or taking on more customers. Missing out on these growth opportunities would be so disappointing.

Buying equipment. Whether you need to replace equipment that broke down, upgrade to the latest model, or simply purchase gear at larger scale, buying equipment is another common reason business owners like you need access to quick working capital.

Making hires. Growing your team and making strategic hires is often key to taking your business to the next level. Invoice factoring services give you the funding you need to staff up quickly and easily.

Marketing. Most new businesses don’t have enough working capital to invest in marketing their services or products. As a result, cash-strapped businesses often rely on word-of-mouth referrals from friends and family members. This is a solid strategy, but a properly executed marketing plan can bring in more business than the initial investment. Using capital for marketing is a smart solution.

Peace of mind. As a small business owner you’re probably used to worrying about poor cash flow issues — we get it. That’s why so many people use invoice factoring to have peace of mind that they can meet their financial obligations with quick access to cash. Invoice funding offers a convenient and flexible cash flow solution that turns your outstanding receivables into cash. You also don’t have to worry about late payment collection, as the factoring company works with your customer to redirect payment.

What Are the 2 Types of Invoice Factoring?

There are two common types of invoice financing that people refer to when talking about invoice factoring examples: recourse invoice factoring and non-recourse factoring.

Factoring with recourse, or recourse factoring, means that you sell your invoice to a factoring company, which then releases an advance payment to you. The invoice factoring company is responsible for debt collection (ie getting the outstanding invoice paid according to the original terms). With recourse factoring agreements, you are responsible for paying back the advance even if the invoice remains unpaid to the factoring company.

Non-recourse factoring, or factoring without recourse, works in much the same way as factoring with recourse. The key difference is that with non-recourse factoring, the liability of your outstanding receivables transfers to the factoring company, so you are not responsible for unpaid invoices.

You might also have head the term spot factoring. Spot factoring give you need-to-access funds from an invoice factor infrequently, but as quickly as possible to cover cash flow challenges. Invoice factoring rates for each type of invoice factoring arrangement will vary.

Next we’ll go over a few examples showing how invoice factoring works in practice.

Like this article so far? You might also like:

- What is Invoice Factoring and How Does It Work?

- Is Invoice Factoring Worth it? [How to Decide]

- How Do You Factor an Invoice? [Step-by-Step Guide]

Invoice Factoring Example #1: Growth Project

Say you’re in the oil and gas industry and a big player puts out an RFP for a massive project. It’s a great opportunity, but you don’t have the capital to pay all the costs up front: buying more equipment, more materials, hiring contractors. You look at all your funding options. Maybe you’ve only been in business two years, so you don’t qualify for traditional bank financing. Or, maybe you would need to raise your line of credit limit with the bank, but that will take months — and you need to know ASAP if you can have the necessary funding ready. Forget about charging expenses to your business credit card either. Their limits are too low, and the interest is too high anyway.

The reason you’re even in this situation is because you’re stuck waiting on slow-paying clients to pay their invoices for 30, 60, or 90 days. You have $250K in outstanding invoices. You’ve already done the work, it’s only fair you get paid on your terms. So, you decide to use oilfield invoice factoring. For simplicity, we’ll say all of them are due in 30 days. So you get your funding of $243,125 in a few days, less a factoring fee of $6,875. The factoring firm waits for your customers’ payment. You go out and win the bid, being able to assure your new customer that you are well-capitalized and can finish the job on time, on budget, with quality work.

Invoice Factoring Example #2: Payroll

For this example, let’s say you’re a temporary staffing company. The people you place into jobs expect to be paid every two weeks. However, your clients only pay you 60 days after being invoiced. That’s a big gap between the cash leaving your business and the cash coming into your business. There’s no way you can take on a big staffing project unless you have more funding ready. This is an ongoing problem, and your bank has already denied you a limit raise on your business line of credit.

So you fund $500K worth of invoices on a regular schedule with staffing factoring, getting your business capital in days for a cost of factoring of $13,750 at a 2.75% discount rate per 30 days. You now have peace of mind about payroll, and you’re even able to take on a new relationship with a major company who opened a local office and regularly needs temporary workers.

Invoice Factoring Example #3: Equipment

Let’s say you’re a manufacturer. A key piece of equipment you use in your process has broken down. You have a backup you can use for now, but you need this new piece of equipment ASAP to get back to full business operations. What are your options? Paying for it yourself would wipe out almost all your cash reserves. You could get an equipment loan, but it will take months to process — if you even get approved. You don’t have enough room on your line of credit, and besides that you regularly draw on it to cover off your operating expenses. You need to pay for this quickly — but a credit card won’t cover the cost (and will cost you a pretty penny in interest fees).

You have $700K in outstanding invoices, so you decide to use manufacturing invoice factoring because you need the funding quickly. The factoring company gives you $680,750 (your invoices less a fee of 2.75% per 30 days) in just a few business days. You’re able to buy your new equipment with no stress and no debt added to your balance sheet.

Should I Factor My Invoices?

We can’t tell you whether you should or shouldn’t factor your invoices. Only you know what the best decision is for you and your business. But we’ll give you a few points to consider when making your decision. Factoring invoices might be right for you if you’re a B2B business that needs funding on short notice, has little credit history (or even bad credit), and can’t get the financing you need such as a business loan or other funding sources through a traditional financial institution, like a business bank.

You might be an especially good fit for invoice factoring if you’re a growing business, you don’t want to take on more debt, or you don’t want to give up ownership dilution by giving away equity. For many business owners like you, factoring invoices makes sense because it’s a fast, flexible, and easy type of financing — especially when you work with FundThrough, as our use of AI, automation, and integrations with Quickbooks and OpenInvoice means getting started only takes a few minutes.

That said, factoring invoices isn’t always the best choice. If you need a really small amount of funding, a lot of factoring companies can’t work with you. Same deal if you sell to consumers, and therefore don’t issue invoices. On top of that, some factoring companies only work with business in certain industries.

Hopefully, this post gave you an idea of some invoice factoring examples, invoice factoring costs, the factoring process itself, and enough context to decide whether it’s right for you. If you’d like to see if you qualify for FundThrough, get started here. It won’t affect your credit score or credit rating, and setting up an account is completely free.

What is an example of invoice factoring?

An example of invoice factoring: A business issues a $10,000 invoice to a client with 30-day terms. A factoring company advances 85% ($8,500) immediately. When the client pays, the factor deducts a 3% fee ($300) and sends the remaining $1,200 to the business. This improves cash flow quickly.