If you occasionally or even frequently experience negative cash flow, you’re not alone. Even brands that are household names, like Tesla, experience cash flow problems from time to time.

Across all industries, business owners struggle to keep a steady flow of incoming cash for the business in order to meet their payroll, inventory, and other operating expenses and financial obligations.

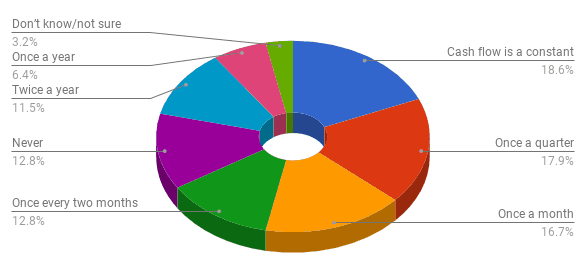

The cash flow crunch affects some types of companies more than others. In the construction industry, for example, a recent Tsheets by Quickbooks survey found that 87% of construction companies experience cash flow problems. Of those, 47.4% experience negative cash flow monthly to quarterly. For 18.6% of these companies, healthy cash flow is a constant problem.

Source: Tsheets (Quickbooks)

Even Big Brands Experience Negative Cash Flow

If you’re beating yourself up over your cash flow woes, stop! It’s a common misconception that gaps in cash flow are caused by poor financial management or a lack of business planning. Even massive brands like Tesla run into trouble. In fact, these major companies have all experienced cash flow issues over the past few years:

- General Electric was forced to sell off parts of its business, as mounting debt and reduced operational revenue contributed to a cash flow crisis.

- Netflix reported nearly negative cash flow of $560 million in Q2 2018 as it poured funds into new content creation, amidst questions about its content accounting practices.

- General Motors (GM) sat at about -$12 million free cash flow for a solid year. Volvo and Jaguar Land Rover were also operating with negative free cash flow throughout 2018, as well.

- African phone giant MTN may also experienced a cash flow crunch after being ordered to pay $10 billion in taxes and dividends the government says it should not have taken home.

So you see, if you’re having cash inflow issues despite running a business that’s profitable based on operational or investment revenue, you’re not alone. In fact, you’re in some pretty great company.

Of course, it’s not necessarily the company you want to keep. Developing a proactive strategy to prevent gaps in cash flow will keep you out of crisis in the first place. If you’re not sure where to start when it comes to managing your cash flow, our Ultimate Cash Flow Guide walks you through the must-dos and must-knows, step by step.

This article looks at some of the financing options that your business can use to either mitigate negative cash flow or use if it’s currently experiencing poor cash flow.

Negative Cash Flow Explained

When your cash outflows for a specific period are higher than your inflows, or money coming in, you’re experiencing negative cash flow. This doesn’t necessarily mean that your business is operating at a loss, but rather that your expenditures outweigh your income for that period. You have move outgoing cash than incoming. Your cash flow break-even point occurs when your expenditures and income for a specific period of time are equal.

How does negative cash flow affect a business?

Many businesses experience short-term negative cash flow; you’re not alone, and it is fixable. However, long-term negative cash flow can have serious business implications. The inability to pay suppliers or employees on time can damage your most important relationships. Additionally, lenders or investors who see negative cash flow and large outflows of cash over time may conclude that your operations do not provide enough income to support the business.

If you’re experiencing poor cash flow, it’s important to get back to a state of equal or positive cash flow as soon as possible. Not only do you need to take care of immediate outgoing expenses like payroll, equipment, and supplies, but negative cash flow over time can be an indicator to potential investors and funders that your business isn’t thriving.

What are the steps to better cash flow management?

1. Practice cash flow forecasting regularly. Maintain accurate and current cash flow statements and financial statements.

2. Develop and implement a cash flow measures strategy, including reviewing operating costs and overhead expenses.

3. Create cash flow policies and procedures to guide your solutions to different types of cash flow issues and save time when you need it most.

4. Use cash flow management solutions to ensure that you always have steady positive cash flow to pay your bills, attract new investment, and invest in business growth.

How do I manage a cash flow crisis?

Managing a cash flow crisis requires an immediate injection of cash, to allow you to resolve your current liabilities and meet all of your financial commitments. Selling capital assets or investments creates liquidity, but these activities can negatively impact your long term ability to generate revenue. That’s why more entrepreneurs and founders are turning to alternative business financing options like invoice funding, to create free cash flow out of outstanding invoices.

Alternative Financing for Negative Cash Flow

If you’re like a lot of small businesses, traditional bank loans aren’t a viable option for solving cash flow issues. Half of low-risk startup financing applicants are denied funding for business loans due to insufficient credit history (another 19% of low-risk startup applicants and 12% of all startup applicants aren’t even sure why they were denied funding). Remember, those are low-risk companies. By the time you’re experiencing cash flow issues, you’re already too risky for the banks.

What tools and business financing methods are available to you as a small business experiencing negative cash flow and cash flow issues? It’s important that you get these lined up now, so they’re available to you when you need them:

- Crowdfunding: an option for ‘sexier’ objectives like launching innovative new products; not ideal for ongoing cash flow management. Beware the low success rate.

- Peer-to-Peer (P2P) Lending: directly borrow funds from multiple investors, typically through a P2P platform. Look for a solution to match you with suitable lenders.

- Line of Credit: can be easier to obtain than a term loan and enables you to pay interest only on the amount borrowed. May require a security against your personal property.

- Merchant Cash Advance: operates in much the same way as personal payday loans, advancing funds against a portion of future debit or credit card sales.

- Invoice Factoring: avoid creating new debt and taking on loan payments by funding your outstanding receivables, making money you’ve already earned available faster.

We’re going to dig into that last option, invoice factoring, a little deeper. Invoice factoring (aka invoice funding) advances funds you’ve already earned. Your ability to secure funding is based on the value of an asset–your accounts receivable–rather than your personal or small business credit history.

It’s a financing tactic that’s been used for many years, but invoice factoring used to be very expensive to use. What’s more, you had to live near an invoice factor or travel to find one. Throughout the 20th century, invoice factors were pretty similar to the payday loans companies we have today–they charged high fees for their service, and were typically a last resort.

At FundThrough, we’ve used technology to resolve those problematic issues in how traditional invoice factoring worked.

You can set up your account online in a couple of minutes, and there’s no credit check or lengthy interview process to endure. Within days, you’ll have an initial funding limit approved and can start funding invoices. There’s no obligation to fund — you can pick and choose which invoices you want to fund, any time you need a funding boost from additional cash flow. Or simply sleep easier at night knowing that you have factoring as a funding option in your back pocket. We clearly show all costs before you fund, so you know exactly what your fees are.

That’s it–no interest, no hidden fees, and no maximum limits on the amount you can fund. And no need for your business to take on long-term debt!

For best results and to ensure that you always have an avenue of financing open to you when a cash flow gap looms on the horizon, get these cash flow tools in order today. They’re a critical part of your cash flow strategy (which should also include a regular schedule of cash flow forecast, cash flow analysis, and budgeting (learn more in our Ultimate Cash Flow Guide).

Now let’s take a quick look at who invoice factoring can help.

Which Industries Benefit Most from Invoice Factoring?

As we learned above, even the most successful-seeming companies can face cash flow issues. One of the main reasons for this is late payments from other companies. You want to be able to offer flexible payment terms to your customers, but have to be able to pay your own bills.

Like construction companies, mining and oil & gas firms may face extremely long invoice payment terms and frequently late payments. Throughout the supply chain on major construction and extraction projects, waiting on payments is a challenge that can prevent a company from moving on to the next project.

This goes far beyond construction, though; the frustration and stress of waiting on payment is near-universal. In addition to the payroll havoc they can cause, late payments also:

- Prevent retailers from purchasing inventory.

- Cripple CPG companies’ ability to enter new markets or launch new products.

- Keep service firms such as cleaning companies and temp agencies from bringing on new talent to staff new contracts.

- Eliminate potential cost savings and efficiencies software firms could enjoy with faster development cycles.

- Pigeon-hole manufacturers into fulfilling orders only up to a certain size, preventing their future growth.

Get Started With FundThrough

Invoice factoring offers a flexible, low-cost cash flow solution that belongs in every type of company’s financial planning arsenal. Sign up for your free FundThrough account today, and we’ll be there for you when you need us.

Want to learn more? Dig into The Ultimate Invoice Factoring Guide to learn more about the financing options available to help you start, maintain, and grow your business.