Business Financing

Invoice Factoring

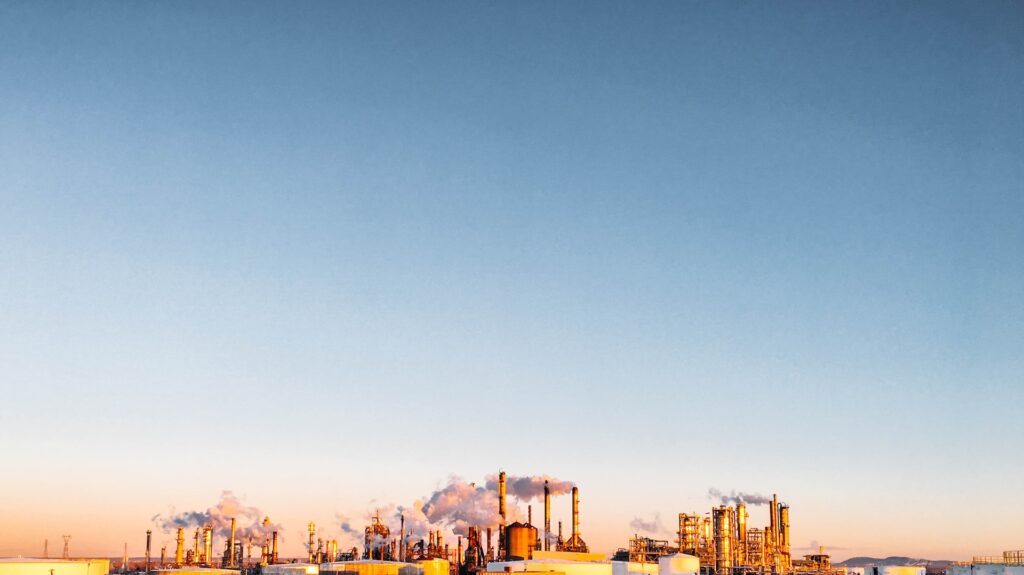

6 Oil and Gas Startup Funding Options [And How To Get Funded]

By FundThrough

As any founder knows, having access to funding for your startup is the key to a successful launch, growth, and ultimately the long-term success of your business. Without access to capital, it’s difficult to cover everyday expenses like payroll and purchasing supplies or equipment, not to mention the challenges of starting an oil and gas business without initial capital. It’s also hard to go after the big projects that can help your business grow. But what are your choices when it comes to oil and gas startup funding options, and how do you access funding?

Real Challenges Faced by Oil and Gas Startups

Managing and overcoming the oil industry’s ebbs and flows is no small feat for startups. The oil market’s notorious cyclic nature means economic highs are often chased by sudden lows, and many businesses are also seasonal, putting a strain on cash flow and operational stability. Here’s a breakdown of the key cash flow challenges oil and gas startups often encounter:

- Extended Payment Terms: It’s not uncommon for invoices in the oil sector to come with lengthy payment terms, ranging from 30 to 120 days. This lag can tie up essential funds, leaving startups in a liquidity crunch and hampering their ability to jump on new business opportunities or even manage day-to-day operating costs.

- High Initial Capital Requirements: The upfront investment capital needed for oil exploration and drilling equipment is substantial. Securing enough startup capital to cover these initial costs can be a significant hurdle, especially for those without a strong financial history or credit rating.

- Volatile Oil Share Prices: Fluctuations in oil share prices can dramatically affect a startup’s valuation and, by extension, its attractiveness to future investors, including venture capital companies and angel investment firms.

- Market Forces and Conditions: External market forces, such as geopolitical tensions or changes in global oil supply and demand, can create unpredictable market conditions, making it challenging for startups to plan and secure a stable source of funding.

- Operational Costs: Beyond initial setup, the ongoing operating costs in the oil and gas sector can be immense. From maintenance of equipment to compliance with regulatory standards, these expenses require constant and often immediate cash flow, putting pressure on startups to maintain liquidity.

By understanding these challenges, oil and gas startups can better prepare and strategize their approach to securing the necessary investment capital and navigating the complex oil markets they operate in.

Oil and Gas Startup Funding Options

There are a wide range of different options when it comes to securing oil and gas startup funding. From the more traditional small business loans for startups to the more innovative, here are 6 oil and gas startup funding options.

1. Invoice Factoring

Prolonged payment terms (60, 90, and even up to 120 days) and fluctuating market conditions pose significant challenges to startups in oil and gas. Invoice factoring can potentially be a key solution, especially for companies grappling with the industry’s unique challenges.

At its core, invoice factoring involves selling your outstanding invoices to a factoring company, enabling immediate access to funds that are otherwise tied up. This process not only accelerates cash flow but also bypasses the typical wait associated with lengthy payment terms, often ranging from 30 to 120 days. Unlike invoice financing, where repayment responsibilities linger on the business owner, (learn about the differences between invoice factoring and invoice funding here) invoice factoring transfers the payment obligation to the factoring company, reducing admin work.

- Key Benefits of Invoice Factoring for Oil and Gas Startups:

- Immediate Liquidity: Overcome the cash flow gaps caused by delayed payments, ensuring your ability to cover operational costs and seize growth opportunities.

- Non-Dilutive Funding: Secure essential funding without giving away equity, keeping control of your company while fueling growth.

- Debt-Free Solution: Access the capital you need without incurring debt, preserving your future financial flexibility.

- Simplified Process: With minimal paperwork and quick turnaround, invoice factoring provides a hassle-free alternative to traditional financing routes.

At FundThrough, we’re familiar with the oil and gas sector, particularly because we’ve funded hundreds of oil and gas companies through our integration with Enverus’ OpenInvoice platform, including startups.

Why Choose FundThrough for Your Oil and Gas Startup?

- Seamless Integration: Direct integration with Enverus’ OpenInvoice and QuickBooks, simplifying the invoice submission process. (We can still fund companies who don’t use Enverus.)

- Unlimited Funding Potential: With no upper limit on funding, you’re never constrained by funding caps for capital-intensive projects

- Transparent Pricing: Benefit from one clear, upfront fee with no hidden charges, allowing for straightforward financial planning.

- 100% Advance Rates: Get the full value of your invoice less our fee.

- Full Flexibility: Choose the invoices you want to fund and only fund when you want to. No long term commitment after your customer pays their invoice.

- Dedicated Support: Enjoy personalized assistance from experienced account managers, ensuring a smooth funding journey from start to finish.

- Rapid Access to Funds: Expedite your cash flow with quick funding turnaround, enabling you to focus on core business growth rather than hassling with cash flow or turning away opportunities.

Ready to explore invoice factoring for your oil and gas startup?

2. Government Funding & Financing for Energy Businesses

For oil and gas startups, the journey to secure funding might seem daunting, but government funding programs offer a promising avenue. The Department of Energy in the United States, other federal agencies, and Canadian counterparts such as Natural Resources Canada (NRCan) and the Sustainable Development Technology Canada (SDTC), have put in place a variety of initiatives designed to fuel innovation in the energy sector. These programs range from grants, which provide funding that doesn’t need to be repaid, to loans with favorable terms, aimed at supporting startups at different stages of growth.

While navigating the application process for these programs can be complex, with detailed proposals and extensive documentation often required, the effort can be well worth it. Startups are encouraged to explore not only federal options but also state or provincial programs, which may offer additional support tailored to the local energy landscape.

Engaging with these government funding opportunities can provide a significant boost to an oil and gas startup, offering financial support that enables further research, development, and scaling of operations. The key lies in understanding the specific requirements and objectives of each program, ensuring your proposal aligns with their goals. With the right approach, government funding can be a cornerstone in your startup’s funding strategy, helping to propel your venture forward in the competitive energy market.

3. Equity Funding

Equity funding is a type of oil and gas startup funding option where you give away a portion of your company in exchange for cash. With this type of funding, there is significant risk involved. If your business is not successful, the investor is out the money they invested. However, if you’re successful, their investment is paid back (with interest). Oil and gas operators may prefer this option as often an investor takes a special interest in the company and helping it succeed. They invest not just their cash, but also their experience in order to help the company be successful.

Equity funding rounds can come from several different sources, including:

- Angel investors. Angel investors tend to invest smaller amounts in companies, but do so quickly. They don’t require direct control, and generally want to make an exit (and get a return on their investment opportunity) sooner than a VC investor. Sometimes an angel funding round can be combined with a seed funding round.

- Venture capital (VC) investors. VC funds are run by seasoned professionals who know how to weigh risks. If your venture isn’t going to look like a solid bet from the outside, you’re likely going to be passed on. Forbes calculated that the probability of a new business obtaining VC funding in the US is very, very small. Learn more if VC is right for your startup.

- Small business investment companies. The Small Business Administration (SBA) licenses and regulates a program called Small Business Investment Companies (SBIC) that provides venture capital financing to small businesses.

- Crowdfunding. Crowdfunding allows startup founders to raise funds from a large number of individuals, reaching potential investors without having to go through the lengthy process of raising venture capital. While they can be equity-based, you can also crowdfund without giving up equity in your business. Equity crowdfunding allows energy companies to remain private but raise funds from the public.

Master Your Cash Flow

4. Exploring Traditional and Modern Bank Financing

Startups gearing up to scale their operations can look into bank financing, which offers a mix of classic and modern financial solutions. This approach includes diverse options like lines of credit, business credit cards, and custom-designed small business loans. Generally best for startups that have moved beyond the early stages, these financing paths require a thorough application journey, complete with a well-crafted business plan that showcases the startup’s pathway to profitability.

- Credit Cards: While credit cards offer immediate access to funds, they often come with high-interest rates and may not provide sufficient credit limits to fully support a startup’s funding requirements. However, they can be an efficient tool for managing smaller, immediate expenses.

- Lines of Credit: A more cost-effective option compared to credit cards, lines of credit offer lower interest rates but might pose a challenge in terms of qualification criteria. As your business evolves, your credit line can expand, providing greater financial flexibility.

Small Business Loans: Tailored loans can offer structured financial support, but they require evidence of a solid business foundation and a clear path to profitability, which might not be feasible for all startups in their early stages.

Bank financing, with its diverse range of options, can complement other funding strategies, offering a reliable foundation for growth as your startup matures.

5. Bootstrapping: The Self-Funded Pathway

Going the bootstrapping route, or self-funding, is a practical choice for oil and gas startups, especially for those with substantial personal assets or who can leverage contributions from friends, family, and their wider network. While some founders might have the means to primarily use personal funds, it’s common for others to supplement their initial capital with financial support from their personal connections, brimming with hydrocarbons. This strategy highlights a dedication to self-reliance and financial self-sufficiency, enabling founders to keep full control over their projects without having to give up a slice of their company.

However, it’s important to note that fully self-funding an oil and gas startup can be challenging. Embracing bootstrapping requires a deep dive into the financial intricacies of the oil and gas sector, from the hefty price tags on equipment and tech to the day-to-day costs of running an emerging business in this field. While combining personal funds with contributions from one’s network can kickstart operations, it is often not sufficient as the only strategy for scaling up. It’s no small feat, but taking this path and complementing it with other funding avenues can cultivate an environment of creativity and toughness, pushing startups to make the most of what they have and carve out paths for significant development.

6. Incubators/Accelerators

For startups seeking not just capital but also guidance and industry connections, incubators and accelerators offer a nurturing ecosystem. These programs are tailored to support startups at various stages of their journey:

- Incubators: Incubators are particularly beneficial for startups in the ideation or early development phase, providing a supportive environment to refine their business model and strategy. They offer resources such as workspace, mentorship, and access to a network of industry professionals and potential investors, facilitating a strong start for emerging oil and gas ventures.

- Accelerators: Tailored for startups that have moved beyond the conceptual stage and possess a minimum viable product (MVP) or initial market traction, accelerators aim to fast-track growth. Participating in an accelerator program can dramatically enhance a startup’s trajectory through intensive mentorship, strategic networking, and often, direct investment. These programs are typically time-bound, focusing on rapid growth and scaling, culminating in a demo day or pitch event to potential investors.

Incubators and accelerators are invaluable resources for oil and gas startups, with a mix of funding, tailored mentorship, and connections. They’re like a safety net for the risky initial phases, laying down a solid foundation for startups to validate their ideas, grow, and draw in more investments.

Start an Oil and Gas Business With No Capital

When it comes to determining the best oil and gas funding options for your startup, there are a few steps to follow.

1. Determine needs. Before reaching out to investors or applying for financing, you need to determine how much funding you’ll need, and whether it’s a one-time sum or ongoing. Use this calculator to help determine your startup costs.

2. Create a business plan. Investors and lenders are going to want to see a business plan that shows your pitch and path to profitability before handing over funding.

3. Determine financial health. You need to know exactly where your business stands financially before you can figure out how much additional funding you need.

4. Research funding options. While this post has no doubt helped you see that there are many oil and gas startup funding options available, you should thoroughly research each option to determine what’s best for your business. There are plenty of free resources available online about how to approach investors, apply for business grants, or distribute equity.

5. Make a repayment plan. Finally, if you’re going to accept capital to help fund your oil and gas startup, it’s important to have a plan to pay it back. An online business loan calculator can help you estimate payments, which should then be worked into your budget. If you can’t make the payment, don’t take the funding.

No one type of oil and gas startup funding will work for every company. Some need a small injection of cash while others need a massive influx. For some, an occasional investment is all it takes to keep growing, while others require consistent access to working capital. Whatever the case is for your business, look at your current finances and available funding options to determine the best path forward. If you’re ready to start shopping for funding options, skim our roundup of the best factoring companies in the USA or the best factoring companies in Canada.

Oil and gas funding for established businesses

It’s worth noting as your company develops that several of these options also apply to established businesses looking for oil and gas funding – bank financing and invoice factoring in particular. A line of credit is cost-effective and convenient since you can draw on it any time. One problem growing oil and gas companies run into is that when they get an opportunity to take on a big project, they hit their line of credit limit quickly, and they either don’t have time to get it raised or the bank won’t help. They risk losing out on the opportunity. While it makes sense to have a line of credit if you can get one, invoice factoring gets you funds in days without debt. It’s also a source of non dilutive funding. You can read about how lines of credit and invoice factoring can work together in this post.