Grow My Business

5 Things to Consider Before Pursuing a Commercial Loan for Your Business

By FundThrough

You’ve probably heard the old adage, “It takes money to make money.” Over most of the past century, funding your business typically meant walking into your local bank and asking for a commercial loan.

Today though, small business owners and entrepreneurs are finding that not only are commercial loans harder to get, they may not be the smartest financing solution, anyway. In this post, we’ll explore small business challenges around funding, how commercial loans work, how much they cost, and what alternatives are available to you.

1. Debt Financing is a Versatile Tool

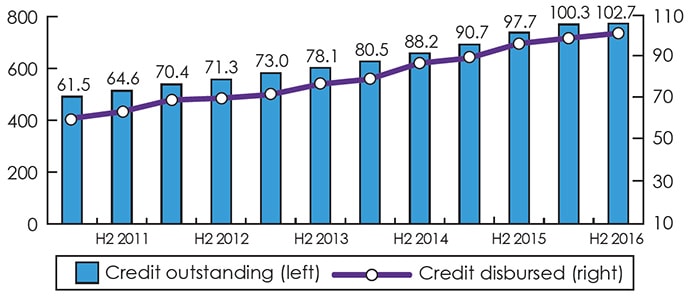

Across North America, small business owners are securing greater amounts of financing and holding more business debt in order to help their businesses succeed. In Canada, both, the amount of credit extended to small business, and the credit they’re holding, have increased steadily for close to a decade now.

Source: Statistics Canada Biannual Survey of Suppliers of Business Financing

According to the National Small Business Association, 69% of small businesses in the US used financing in 2016, including loans, credit cards, venture capital, and crowdfunding. (The remaining 31% were not able to obtain adequate financing.)

When it comes to the success of your small business, free cash flow is critical in meeting your current obligations, financing new inventory and contracts, and investing in the growth of your business. Lacking a financial ‘cushion’ built up to draw from and having even one sizeable invoice out for 30 to 60 days can have a crippling effect on your cash flow.

Debt financing is a versatile tool that can offer your business some much-needed relief in a cash flow crunch or the growth capital to keep going when your business is moving faster than your customers’ payment terms.

2. Why Commercial Loans Are so Challenging for SMBs to Obtain.

Commercial loans and other traditional financing can be hard for small companies to come by. New and small businesses simply lack the credit history and financial records that lenders like to see as they’re making lending decisions.

In both Canada and the United States, the two main sources for commercial loans for all sizes of business are banks and government. North of the border, domestic banks fund over 50% of business loans and in the U.S., commercial banks granted $12 trillion in loans in August 2018.

Big bank loans are big business; unfortunately, most banks just aren’t that interested in small business clients.

In Canada, less than half of startups are able to access credit from financial institutions. More than 80% rely on alternative funding sources such as the entrepreneurs’ savings and personal loans taken out by owners. And according to the Federal Reserve, about 55% of the over 28.8 million small businesses in the United States received funding from their owners’ personal savings, retirement accounts, home equity loans, or personal loans in 2014.

Bootstrapping your business in this way isn’t an option for everyone, especially once those wells are tapped for startup and you enter growth phases in need of funding.

3. How do Commercial Loans Work?

A commercial loan or business loan is an arrangement between a business and a lender whereby the lender will provide funding and the business, in turn, pays it back with interest.

Commercial loans are most often used to fund capital expenditures or major operating expenses. They can be used to meet short-term financial obligations such as funding payroll but are unlikely to be approved for those purposes due to the risk involved.

Typically, there’s a set loan term with a strict repayment schedule. And more often than not, the lender will want to see some form of collateral they can confiscate if you default and are unable to pay back the loan.

4. How Much do Commercial Loan Cost?

Interest rates for commercial loans vary widely depending on factors including:

- your personal and/or company’s credit history,

- your relationship with the lender,

- what type of lender you’re using (whether it’s a bank or private lender),

- the term of the loan (how long you need the money)

- whether or not you’ve put up collateral

- and more.

Shopify offers a fairly simple online business loan calculator that you can play around with to estimate the cost of borrowing this way. But keep in mind that even when a loan agreement offers a rate of interest close to prime, there will most likely be a schedule of penalties that can be applied if you miss payment(s), as well. If you’re already experiencing cash flow issues, the last thing you want to do is exacerbate them with incremental interest rates or loan penalties.

Bank lending is declining in a number of countries, while small and medium-sized businesses are increasingly turning to alternative sources of financing (OECD). The high cost of commercial loans is partly responsible.

In summary, commercial loans may be an option, but keep in mind:

Commercial Loans Pros:

- can be used to fund capital investments and operational expenses

- typically lower interest rates when compared to credit cards, lines of credit, and private lending

- long repayment terms available, enabling you to pay back large amounts over time

- you retain control and ownership of your company

Commercial Loans Cons:

- difficult to obtain without stellar credit

- application process is cumbersome and time consuming

- commercial loans often require collateral

- higher cost compared to invoice funding

- less autonomy over funds, as how you will spend them is typically part of the borrowing agreement

5. What Are the Most Common Types of Alternative Finance?

Alternative funding refers to all the non-bank options that are available for small businesses, such as non-bank lending (including online lending), crowdfunding, P2P lending, angel investors and venture capitalists, and factoring or invoice advances.

Pros:

- a large number of investors each fund a small amount

- you can incentivize investments with rewards or a stake in the company

- it can help your company build hype and gain visibility

- you can raise money quickly, in the right conditions

Cons:

- success rates are discouraging; less than 1/3 of crowdfunding campaigns reach their goal

- investors or lenders can be an important source of business intelligence and mentorship, which you don’t get with crowdfunding; in fact, you may find yourself pulled in many different directions

- making your product public before it’s ready can result in copycats

- failing to reach your goal might mean returning all funds raised, putting you back to square one

Pros:

- you can raise funds directly from numerous investors

- P2P borrowers tend to enjoy interest rates lower than those offered by banks

- One of the fastest-growing segments in the financial services industry, peer-to-peer lending is available through hundreds of sites globally. As of 2017, the volume of global payments and remittances was over $1 trillion yearly, with per annum growth rates in peer to peer lending volumes reaching 50%.

Cons:

- you’ll have to undergo a credit check and meet lending criteria

- P2P lending is legal, but the regulations in both Canada and US are complex

Pros:

- a small business line of credit can be easier to obtain than a term loan and enables you to pay interest only on the amount borrowed

- you can draw funds from the line of credit at any time, as long as the maximum loan amount is not exceeded

Cons:

- may require a security against your personal property

- in some arrangements, minimum monthly payments may be applied to interest only

- requires a credit check; may not be available to brand new companies or owners with poor credit history

Pros:

- you can deduct the cost of interest on the loan and this method of financing is tax-neutral

- approval and dispersal are typically fast

Cons:

- repayment is directly tied to future sales

- merchant cash advances are not bound by usury laws and can charge higher interest rates

- merchant cash advance payments are automated and typically withheld by the credit card processor until the initial amount plus interest is paid back in full

Venture Capital or Angel Investing

Pros:

- funding may come with mentorship

- VCs and angels may bring important connections and relationships to the table

- your idea and the health of your business are thoroughly vetted

- if the business fails, you are off the hook and do not have to repay the financing

Cons:

- pitching can be time consuming and discouraging

- you lose a portion of ownership and some control

- there’s a risk that your goals and priorities do not align with your investors’

Pros:

- helps businesses with slow-paying customers meet their immediate cash flow needs and cover business expenses

- provides fast, ongoing access to cash at a lower rate than most other options

- unlike a loan, invoice factoring doesn’t add a liability to your balance sheet

- no credit check; your funding limit is based on the strength of your customers’ ability to pay the invoices

- technological integrations reduce paperwork and fees

- you retain control and ownership of your company

Cons:

- The drawbacks of traditional invoice factoring–geographic restrictions, high funding fees, factors collecting on client accounts–have been solved with FundThrough’s innovative technology and simple, low fee structure.

Put FundThrough to Work for Your business

Want to learn more? Dig into The Ultimate Small Business Finance to learn more about the financing options available to help you start, maintain and grow your business.