Business Financing

Working Capital Management

Financing for Immigrant Entrepreneurs in Canada

By FundThrough

If you dream of starting your own business as a newcomer to Canada, you’re not alone. Four to seven years after arriving, immigrants are more likely to own a private incorporated business or be operating as an unincorporated self-employed than the Canadian-born population. For new Canadians, entrepreneurship offers an opportunity to pave your own way; to build a career with greater potential and flexibility than employment.

However, immigrant and newcomer entrepreneurs face several unique challenges when applying for capital funding to support their ventures in Canada.

How can you give your fledgling business the best start in your new home country?

Small Business Finance Challenges for new Canadians

Whether supported by family or coming to Canada as first generation immigrants, newcomers typically have very few assets upon their arrival. Outside of the tangible–home furnishings, a vehicle, weather-appropriate clothing–there are things you simply cannot bring with you. Your credit history from your home country, for example, won’t be considered as you apply for funding to finance a new business in Canada.

“Four to seven years after arriving, immigrants are more likely to own a private incorporated business or be operating as an unincorporated self-employed than the Canadian-born population”

More than 200 languages are spoken in Canada, but most official paperwork associated with business registration, licensing and financing is available in the two official languages, French and English. Language barriers can make meeting with lenders and applying for funding challenging.

Further, in lieu of credit history, traditional lenders typically ask that new Canadians have a friend or family member personally guarantee any financing. Arriving on your own can make equity funding and finance co-signing impossible.

Traditional Business Loans & Credit for Immigrant Entrepreneurs

There are three levels of government you can look to for programs and incentives to help finance your business idea: federal (country-wide), provincial, and regional or municipal. Typically, these programs will complement other funding; they will not act as a single source for financing, so you’ll still need to bring other sources of funding to the table.

If you’re 39 years of age or younger, for example, you might qualify for the Government of Canada’s Futurpreneur program. It provides mentoring and a limited amount of financing to help start-ups get off the ground. Each province offers its own programming, such as Ontario’s Microlending for Women Program, which provides microloans to qualifying low-income women. In order to be eligible, you must first participate in the program’s financial literacy training, entrepreneurial mentoring and skills development and life skills support.

Non-government sources of small business financing include banks, credit unions, angel networks and specialized loan sources like the Business Development Bank of Canada. Banks and credit unions typically want to see an established Canadian credit history, making their loans difficult to impossible for newcomer entrepreneurs to obtain. Angel investment and equity financing can mean a loss of control of your business, with diminished returns for you, the entrepreneur, for the life of the company.

How Alternative Finance Helps

Thankfully, there are alternatives. Looking beyond the traditional sources of funding – stocks, bonds and cash – opens to the door to more flexible financing for your fledgling Canadian business.

Most alternative finance companies evaluate businesses seeking financing in non-traditional ways. They aren’t relying on your credit score or ability to fill out long forms to make a decision on whether to help finance your business. Because these aren’t traditional loan agreements, alternative finance companies can look beyond the simple formula of giving you money today that you will repay with interest in instalments over a certain period of time.

One option that seems popular on the surface is crowdfunding. Platforms like Kickstarter, IndieGoGo and RocketHub allow you to share your business idea with the world and solicit micro-investments from the ‘crowd.’ If you only read the occasional headline about a startup raising hundreds of thousands of dollars this way, it might seem like a viable financing option. However, while there are a few incredibly successful outliers, most crowdfunding campaigns fail. In fact, up to 89% fail to reach their funding target.

There’s an alternative that ensures you have cash flow when you need it, without sacrificing ownership and control of your new business. Invoice factoring is a small business finance solution that frees up cash you’ve already earned, so you don’t need to worry about having another monthly payment to cover over your initial years of business. No credit is required, as your creditworthiness is based on the strength of your sales. There’s no lengthy paperwork and approval process, and you don’t need to have collateral to obtain financing.

Explore FundThrough’s Ultimate Cash Flow Guide

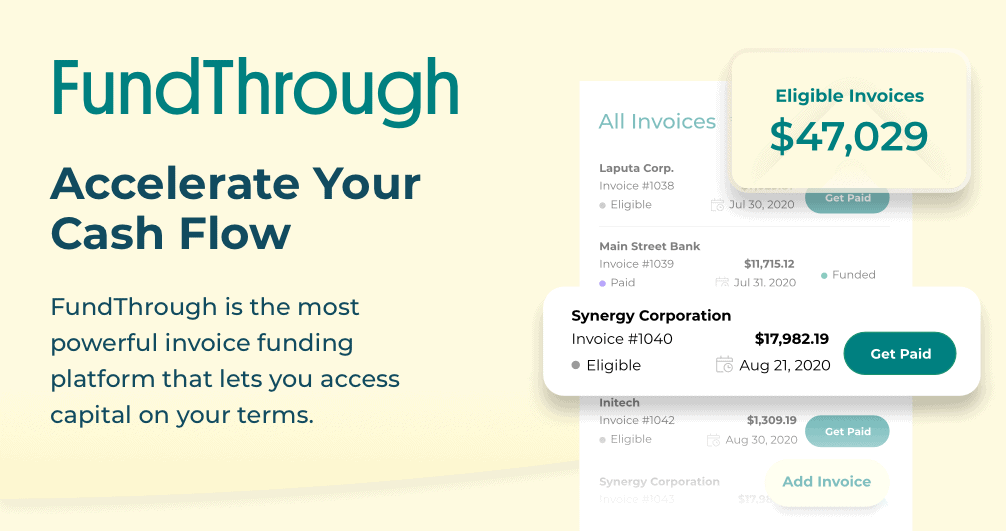

With FundThrough’s invoice factoring, you don’t need to convince anyone else of your new company’s viability. Your sales speak for themselves.

Here’s how it works. Once you’ve set up your account online, you simply connect FundThrough to your invoicing app and let us know where to deposit your funds. Within 24 hours, we’ll have reviewed your invoices and let you know what your initial limit is. We advance the funds you have already invoiced, so you don’t need to wait for payment. This allows you to extend reasonable payment terms to your customers, without sacrificing your ability to pay your expenses and employees, purchase capital equipment, and invest in the success of your new business.

You don’t need to rack up debt or put the success of your business in someone else’s hands. FundThrough’s invoice factoring gives you access to liquid capital you’ve already earned, when you need it most. As your business grows, we regularly reevaluate your account and increase your limit, so your financing grows with you.

Want to learn more? Take FundThrough for a test drive and see how simple capital financing can be, even if you’re brand new to Canada

Suggested Readings

The 10 Best Banks for Small Businesses in 2025

READ

Same-Day Business Funding: 3 Best Options & Tips for Success

READ

Strong Canadian Support is Critical for Small Businesses to Survive—And Even Thrive—Amid Trump’s Tariff Chaos

READ

7 Best No Credit Check Business Funding Options: Success Tips for SMBs

READ

FundThrough Named Best Overall Invoice Factoring Company by Top Business and Finance Outlets

READ

Lima Charlie: Raising $8M in 30 Days to Unlock New Growth Channel

READ