Fast, Flexible Invoice Factoring for Columbus

Get consistent cash flow for your Columbus, Ohio-based business for growth and everyday expenses by getting your invoices paid in days.

Cash Flow is the #1 Problem Facing Columbus Businesses

As entrepreneurs and finance pros ourselves, we understand the difficulty of having hundreds of thousands of dollars in accounts receivable, but not enough consistent cash for taking on new business or everyday operational expenses, like payroll. While Columbus is consistently ranked as one of the top cities for business and entrepreneurship in the United States, it’s a hub for many industries – like staffing, manufacturing, healthcare, education, and technology – that struggle with cash flow issues. That’s why we built FundThrough, a tech-powered platform that pays your outstanding invoices early through a quick, easy experience.

Featured in:

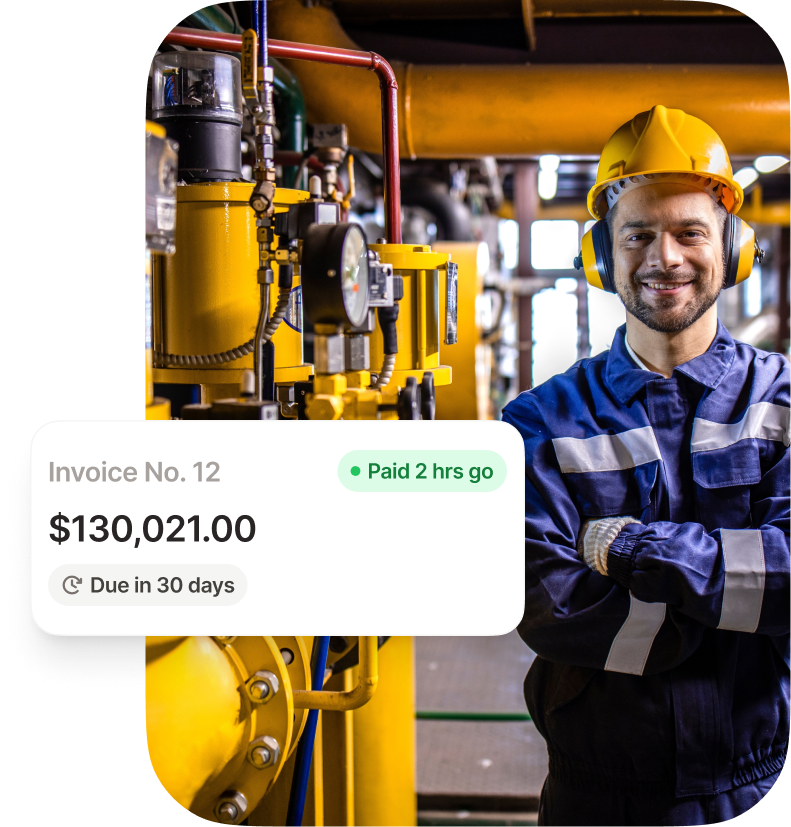

Get Paid on Your Terms, Not Net Terms

Why Columbus businesses choose FundThrough

Unlimited Working Capital

Get as much funding as you have in eligible unpaid invoices for growth opportunities, payroll, and beyond with just a few clicks (after setup).

Fast, Flexible Funding

Choose the invoices you want to fund (aka spot factoring) and get next day payment. You’re never obligated to factor invoices.

Easy Experience

Our simple app and dedicated support make the factoring process easy. We also offer 100% advance rates and charge one flat rate with no hidden fees.

How It Works

Create an account in minutes

Tell us about your business and get a quick pre-qualification. Upload your invoices for quick, easy funding through the FundThrough platform.

Choose the invoices you want to fund

Pick which invoices you want paid quickly. We’ll verify the invoice and your customer to give you peace of mind about your payments.

Get paid and get growing

You’ll see payment in your linked bank account the day after invoice approval. We’ll handle your accounts receivable and inform you when your customer pays their invoice.

How we work with your customers

Your customer relationships are critical to your success. That’s why our team treats them professionally and minimizes their role in the funding process.

Your customer will verify that they’ve accepted your invoices and send all future payments to FundThrough. We’ll send any future invoice payments you don’t fund to you as we receive them

What to Look for in a Columbus Invoice Factoring Company

Comparing invoice factoring service companies requires you to evaluate several key aspects of their financial services such as funding limits, costs, service level agreements, and level of commitment required. Look for a partner who understands your needs and helps you proactively stay well-financed for the long term to meet your business goals.

Key features to consider in a receivable financing partner include:

- Funding limit: which ranges from as low as $500 to unlimited funding.

- Advance rate: the percentage of the outstanding invoice the company gives you upfront, typically between 80% to 95%.

- Pricing: Competitive factoring rates range from 1% to 6%. Ask about any hidden fees, which are separate from the percentage of the invoice the factoring company keeps as their fee.

- Speed: read the contract to check SLAs for passing through unfunded invoices, not just those you get paid early.

- Cost: Ask about fees in addition to the main factoring fee, like service or application fees.

- Flexibility: Will you be required to fund a certain amount of your receivables or can you choose when you fund? Can you choose which invoices get funded?

- Process: Ask how you’ll submit invoices for funding. The factoring process needs to be easy or it will waste time-the opposite of how invoice factoring programs should work!

Gathering this information for each Columbus invoice factoring company you’re considering will help you choose the factoring partner that’s the best fit for your business. Learn more about the best receivable factoring companies serving Columbus.

How to Qualify for FundThrough

Every Columbus invoice factoring company has its own requirements for funding unpaid invoices. Here’s what ours look like:

- Customers who are other businesses

- Up-to-date status on your business taxes (or payment plan in place)

- A customer who is likely creditworthy (whose invoices you’d like to factor)

- Unpaid invoices for completed work

- No liens on your accounts receivable that you aren’t willing to have removed

- Documents such as Articles of Incorporation, a color picture of your photo ID, a void check for you business’ bank account

- A customer who is prepared to respond to the NOA (Notice of Assignment) in a timely manner

Ready to get paid early?

On the Intuit Quickbooks App Store:

"I am pleased to recommend FundThrough for early stage and established small business funding for the type of products and ease of doing business." ~James R.

"I've been looking for this tool for the past few years and stumbled on FundThrough during my participation at QuickBooks Connect. They have a great software." ~Xtiane

"I really like this company, they are 1st class! They have a very nice platform and are at the top of their game! They have fast approvals and will help you along the way..." ~Unified

On Google Reviews:

"FundThrough has been instrumental in helping my company meet its cash flow needs quickly, easily and for low cost." ~Mark B.

"We started using FundThrough in August of 2017. What impressed me the most has been the quick turnaround." ~Ahmed A.

"Overall I have been quite satisfied with FT. I signed up with them about eight months ago and have used the service once. I've also recommended it to other clients." ~Stephanie

Industries We Serve

We serve a variety of local industries with cash advances on their invoices, including (but not limited to):

- Staffing agencies

- Manufacturing companies

- Healthcare providers

- Education institutions

- Technology companies

- Retail businesses (B2B)

- Transportation and logistics companies

- Consulting firms

- Government contractors and suppliers

Learn more about how Columbus invoice factoring helps your industry with healthy cash flow.

Other Locations Served Near Columbus, Ohio

Columbus receivable financing serves surrounding cities with reliable cash flow, such as:

- Dublin

- Powell

- Westerville

- Upper Arlington

- New Albany

- Hilliard

- Gahanna

- Pickerington

- Delaware

- Grove City

Invoice Factoring vs Banks: Which is Better?

Neither is better. Banks and invoice factoring can work well together to provide access to cash for different purposes. Invoice factoring can be a helpful supplement to a line of credit when you can’t get approved for a limit increase, or if you need funding faster than you can get an approval.

Invoice factoring (or invoice financing) is a better choice for certain situations. For example, many new or small businesses can’t get qualified with banks, even if they’re growing, because they don’t yet have a track record showing financial stability. And so often, growth opportunities require quick funding. Eliminating net terms with timely payments solves these problems quicker and easier than a traditional bank loan or line of credit could, making it a more effective solution in this case.

Questions about Columbus invoice factoring?

Speak with your dedicated account manager on the phone or online.

+1 (800) 766-0460

Toll-free Mon-Fri 9am-5pm ET

Chat online

Use the chat icon below

Email sales

Frequently Asked Questions

Users have the ability to fund invoices of any size on FundThrough’s platform. Invoices must be less than 90 days old to be eligible for funding. If you use QuickBooks or OpenInvoice, eligible invoices will be pulled into your account.

Innovation is one of our company values! FundThrough leverages technology to automate many of the manual processes that traditional financial institutions still use today. This allows us to pay your invoices in as little as one business day (after setup and approval).

FundThrough analyzes provided or publicly available information about you and your customer’s business along with information from your accounting software to assess your cash flow (if applicable).

No. Creating a FundThrough account and advancing invoices will not affect your credit score.

We are obligated to report any bad-faith or fraudulent activity to the appropriate credit bureau.

Yes. FundThrough uses secure, bank-grade, 256-bit encryption to protect your data. We never see or store third-party usernames or passwords.

Yes, opening and keeping a funding account doesn’t cost a thing. We don’t charge hidden fees, and you’re never obligated to advance invoices.

Yes, you can cancel your account so long as you don’t have any open requests or outstanding balances. Please connect your account manager or our client support, and they will assist you in canceling your account.

FundThrough was launched in 2014 and has since shot up to become a leader in the financial technology space, funding tens of millions of dollars in invoices every month. We’re backed by some amazing VC and angel investors and are continuously developing new products to serve under-banked small businesses across the U.S. and Canada.

We advance you the full value of your invoice minus one fee based on your invoice terms. That’s it: no hidden fees. You’ll always see your fees before agreeing to fund an invoice. Learn more on our pricing page.