HOW FUNDTHROUGH WORKS

Get paid on your terms. Get back to business.

FundThrough pays outstanding invoices in days ahead of net terms through an easy, tech-powered process. Unlock capital for growth projects or everyday expenses.

- Create or connect your account in minutes

Create a free account or connect your QuickBooks or OpenInvoice account.

- Outstanding invoice of at least $100K in accounts receivable or invoices to one customer

- Invoice other businesses (B2B) or government agencies

- Invoices are for completed work (with an expected due date)

- No construction or real estate

- No explicit liens on receivables that you aren’t willing to have remove

We’ll need these documents to get started:

- Business formation documents such as LLC certificates, Articles of Incorporation, or some other proof of business.

- Government-issued photo ID (e.g., driver’s license or passport).

- Void check from your business checking account.

- Authorization to review your business’ tax history.

We may request other information to verify your business and your customers.

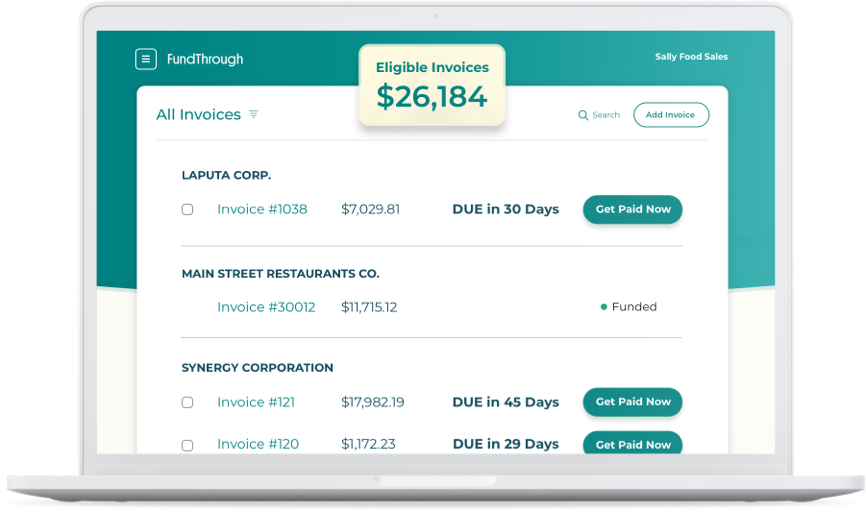

- Select invoices to fund

Upload your invoices, or connect to QuickBooks, Xero, or OpenInvoice to sync them automatically. Our accounting software integrations streamline the process even more, amplifying the ease and speed of getting funded.

- Get paid

We work with your customer to redirect payment to FundThrough and verify your invoices. Once the approval is complete, you get next-day payment to your linked bank account.

- Get back to business

Once your customer pays the invoice to FundThrough based on the net terms, there’s no more commitment. You can fully focus on your business. Get another quick, easy invoice payment through the platform any time you need more funding.

Learn more about how we work with your customers

Get Your Invoice Paid In Days

Frequently Asked Questions

FundThrough integrates with QuickBooks Online and OpenInvoice to save you time during setup. If you use Xero, you can sync your FundThrough account to pull in eligible invoices after signup. If your software isn’t supported, don’t worry – you can create a free account and manually upload invoices onto the platform.

We’ll need to contact your customer so they can pay the invoice total to FundThrough according to the original terms. Understandably, this is often a concern for our clients: the way we work with them reflects on you. That’s why we always keep interactions positive and professional, and we’ll always contact you before we contact your customer. Learn more about how we work with your customers.

You can fund invoices of any size on FundThrough’s platform – yes, that means unlimited funding! Invoices must be less than 90 days old to be eligible for funding. If you connect your QuickBooks or OpenInvoice account, FundThrough will automatically pull invoices that are eligible for funding onto your dashboard.

Innovation is one of our company values! FundThrough leverages AI technology to automate the manual processes that many traditional financial institutions still use today.

If you need alternative arrangements to pay an invoice, reach out to our client success team who will work closely with you to find a solution that fits your business.

No. Creating a FundThrough account and advancing invoices will not affect your credit score.

We are obligated to report any bad-faith borrowing or fraudulent activity to the appropriate credit bureau.

Yes. FundThrough uses secure, bank-grade, 256-bit encryption to protect your data. We never see or store third-party usernames or passwords.

Yes, opening and keeping a funding account doesn’t cost a thing. We don’t charge annual fees and you’re never obligated to advance invoices.

Please contact your account manager, and they will assist you in cancelling your account.

FundThrough was launched in 2014 and has since shot up to become a leader in the financial technology space, funding more than a billion dollars in invoices. Learn more about FundThrough.