Invoice funding for energy, oil & gas

Skip the wait to get paid

End your invoicing frustrations and cash flow challenges. Get your invoices paid in days - instead of months - to unlock working capital to grow your business.

By clicking “Get started with a free account now,” you authorize Enverus to release relevant data to FundThrough to enable its services as defined in its terms and conditions.

Why Factor with FundThrough?

FundThrough has funded more than a billion dollars to thousands of businesses in the energy industry across the U.S. and Canada.

Quick Process

Apply in less than 5 minutes. Our online platform gives you access to funds from outstanding invoices in days.

Simple Pricing

Instant funding with one flat fee. No hidden fees or obligation to fund. Fund the invoices you want, whenever you want.

Industry Experience

Our account owners are experienced with the complexities of oil and gas invoicing. Get in touch anytime.

Enverus Integration

If you use OpenInvoice or WorkBench, simply connect your account and start funding faster.

FundThrough is a trusted partner of the OpenInvoice network

No obligation to fund, no application fee, no annual fee. Pay only when you fund.

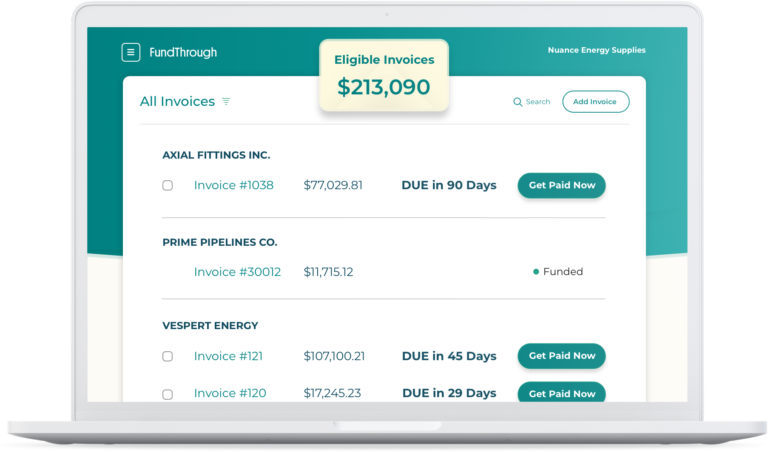

How it Works

- Connect or create your account

- Select the invoices you want to advance

- Get your funds, less fees, in days

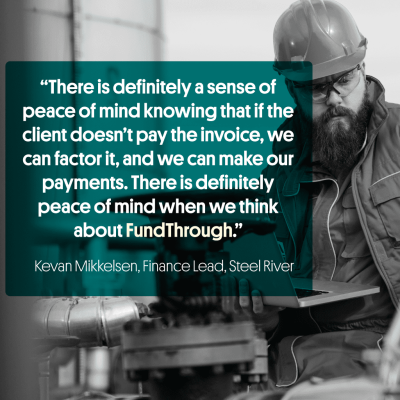

Case Study

Steel River’s leadership had a lot of questions about factoring. But FundThrough proved that invoice factoring wasn’t just a simple way to improve cash flow, but it was also a vital tool to drive growth and ultimately reduce the stress that comes with running a business.

– STEEL RIVER GROUP

Ready to Convert Outstanding Invoices into Cash Flow?

- +1-877-843-0531

- [email protected]

FAQs

Why do small businesses in the oil & gas industry use invoice factoring?

The oil & gas industry in North America is a profitable yet challenging one. The biggest hurdle business owners face in the way of growth is cash flow. Liquidity problems generally arise from slow-paying customers, which is the norm in the oil and gas industry.

Extended customer payment terms mean business owners within the oil and gas industry often wait more than 90 days for invoice payment – making it difficult for these small businesses to maintain their cash flow and take on new projects.

Factoring allows businesses to convert their outstanding invoices into cash flow quickly. Getting funds through invoice factoring is faster, easier, and more accessible than traditional oil and gas loans. It is also a great option for new oil and gas businesses, as it doesn’t require stringent credit checks or lengthy sales records.

What are the benefits of oil & gas factoring?

• Reinvest back into the business

• Make payroll on time and keep their employees happy

• Take on more projects and find new customers to grow

• Pay their own suppliers on time

All of this, without incurring new debt.What types of businesses use oil & gas factoring?

Oil and gas factoring is used across the industry in various services. Services include site maintenance, site exploration, pipeline construction, and surveying and mapping oilfields. If you are involved in any oil and gas business, chances are you have slow-paying customers.

Is oil & gas factoring the right solution for my business?

No obligation to fund, no application fee, no annual fee. Pay only when you fund.

Got Questions?

We’re here to help! Our dedicated support team can answer all of your questions and get you on your way to cash flow freedom.

Call +1 (800) 766-0460

Toll-free Mon-Fri 9am-5pm ET