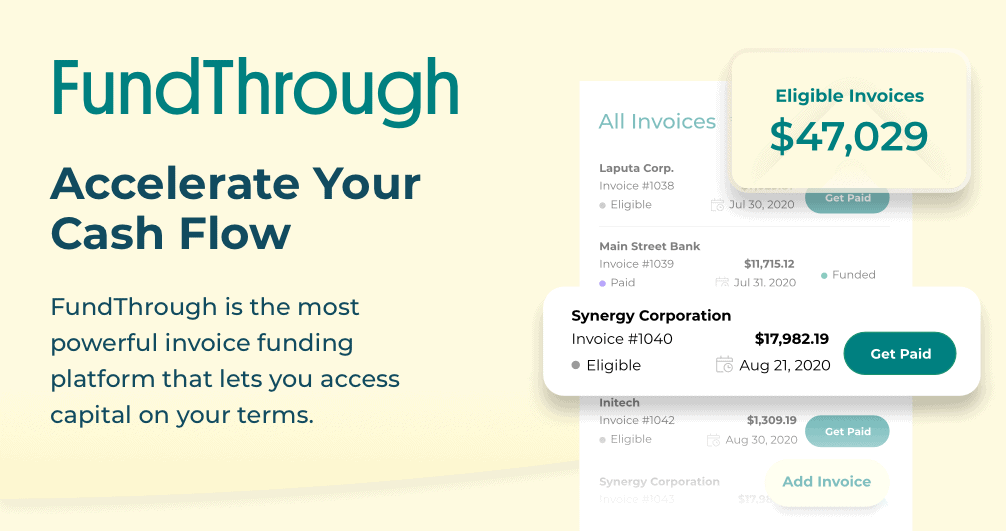

THE FUNDTHROUGH PLATFORM

Tech-Powered Invoice Funding For Quick, Easy Capital

Intuitive platform pays outstanding invoices in days for flexible funding

Technology Makes Invoice Funding

What it Should Be

Invoice funding (traditionally known as invoice factoring) isn’t new. Many companies will pay your invoices ahead of net terms. However, the policies and manual processes of traditional invoice factoring result in a slow, expensive, rigid solution.

Tech-powered invoice funding solves the problems of traditional invoice factoring while making the benefits even better. FundThrough is built with artificial intelligence for a streamlined experience. Combined with our straightforward policies and our dedicated team, you get quick, easy, flexible invoice payments that let you get back to business.

How FundThrough Optimizes

Traditional Invoice Funding

Velocity

Invoice Factoring

Time to Get Funding

In days.

Capital AvailableUnlimited funding based on the size of your invoices.

Pricing100% of the invoice paid, minus a single fee. No hidden fees.

FlexibilityFund whatever invoice to whatever customer you want.

Customer SupportPositive and responsive.

TechnologyStreamlined, AI-powered processes.

Traditional

Invoice Factoring

Time to Get Funding

One week to one month.

Capital AvailableRigid funding limits based on your business.

PricingHefty processing fees, late fees, and early termination fees.

FlexibilityRequired to fund all your invoices to all your customers.

Customer SupportLimited support staff.

TechnologyManual, slow processes.

- Accounting integrations with QuickBooks Online, Xero, and OpenInvoice avoids duplication of effort

- Eligible invoices automatically synced

- AI-powered platform generates custom funding offers

- Intuitive flow for setting up first funding with a new customer (Single Session Onboarding)

- One click to submit invoices after customer set-up starts the funding process in seconds

- Visibility into individual invoice status

- On-demand reporting to easily reconcile your accounting

- Secure, bank-grade 256-bit encryption to protect your data

- Optional auto-fund*: have all invoices from a customer automatically submitted for funding for an even more streamlined experience

*Additional approval required. Linked QuickBooks Online or OpenInvoice account required. Unsubscribe anytime.

How Invoice Funding with FundThrough Works

STEP 1

Connect or Create an Account

Upload invoices or connect to QuickBooks or OpenInvoice to pull them in automatically.

STEP 2

Select Invoices to Fund

Choose any invoices you would like to fund.

STEP 3

Get Funded

Receive a deposit in your bank account in a matter of days, on approval.

Your Funding Partner Dedicated to Your Success

Our team is here to help every step of the way.

On the Intuit QuickBooks App Store:

"FundThrough was easy to set up and once set up, funding is fast and easy. They are also very flexible. Highly recommend! Thank you!" ~Tomlin17

On Google Reviews:

"Great service and the team behind it is even better! Always there to help." ~Matthew M.

FundThrough client since 2017.

Frequently Asked Questions

FundThrough integrates with QuickBooks Online and OpenInvoice to save you time during setup. You can sync your Xero account to pull in eligible invoices after setup. If your software isn’t supported, don’t worry – you can create a free account and manually upload invoices onto the platform.

You can fund invoices of any size on FundThrough’s platform. Invoices must be less than 90 days old to be eligible for funding. If you connect your QuickBooks or OpenInvoice account, FundThrough will automatically pull invoices that are eligible for funding onto your dashboard.

Innovation is one of our company values! FundThrough leverages technology to automate the manual processes that many traditional financial institutions still use today.

If you need alternative arrangements to pay an invoice, reach out to our client success team who will work closely with you to find a solution that fits your business.

No. Creating a FundThrough account and advancing invoices will not affect your credit score.

We are obligated to report any bad-faith borrowing or fraudulent activity to the appropriate credit bureau.

Yes. FundThrough uses secure, bank-grade, 256-bit encryption to protect your data. We never see or store third-party usernames or passwords.

Yes, opening and keeping a funding account doesn’t cost a thing. We don’t charge hidden fees and you’re never obligated to advance invoices.

Please contact your account manager, and they will assist you in cancelling your account.

FundThrough was launched in 2014 and has since shot up to become a leader in the financial technology space, funding more than a billion dollars in invoices. Learn more about FundThrough.

Invoice Funding Resources

The 10 Best Banks for Small Businesses in 2025

READ

Same-Day Business Funding: 3 Best Options & Tips for Success

READ

Strong Canadian Support is Critical for Small Businesses to Survive—And Even Thrive—Amid Trump’s Tariff Chaos

READ

7 Best No Credit Check Business Funding Options: Success Tips for SMBs

READ

FundThrough Named Best Overall Invoice Factoring Company by Top Business and Finance Outlets

READ

Lima Charlie: Raising $8M in 30 Days to Unlock New Growth Channel

READ